Thinking about getting solar panels? One of the first questions on your mind is probably, "Is it actually worth the money?" That's where a solar return on investment (ROI) calculator comes in.

This isn't just some fancy tool; it's designed to give you a clear financial picture of what to expect from a solar panel system over its entire lifespan. It crunches the numbers by weighing your total costs against all the money you'll save, then spits out a simple percentage. In other words, it helps you figure out if going solar is a smart financial move for you.

Is Going Solar A Smart Financial Move?

Before we get into the nitty-gritty of the calculations, let's shift our perspective a bit. It’s easy to see solar panels as just another home improvement project, like remodeling a kitchen. But it's far more accurate to think of them as a long-term financial asset—almost like a mutual fund that happens to sit on your roof and power your home.

This investment starts paying you back almost immediately. The most obvious return is watching your monthly electricity bill shrink or disappear entirely. Every single dollar you don't have to send to the power company goes straight back into your pocket. That’s a direct return on your investment.

Understanding The Key Drivers Of Solar ROI

Your total return isn't just about what you save on energy. Several key factors work together to shape just how profitable your solar system will be. To get a handle on your potential ROI, you'll need to gather a few key pieces of information.

The table below breaks down the essential inputs you’ll need for an accurate calculation. Think of this as your personal data-gathering checklist.

Key Inputs for Your Solar ROI Calculation

| Input Category | What It Means | Where to Find It |

|---|---|---|

| System Cost | The total price of your solar panel installation, including equipment, labor, and permits. | Get quotes from reputable solar installers. This is the starting point for your calculation. |

| Electricity Bill | Your average monthly or annual electricity usage (in kWh) and what you pay per kWh. | Look at your last 12 months of utility bills. Most provide a summary. |

| Incentives & Rebates | Federal tax credits, state rebates, and any local incentives that lower your upfront cost. | Your solar installer can provide specifics, or check the Database of State Incentives for Renewables & Efficiency (DSIRE). |

| Utility Rate Increases | The projected annual increase in electricity prices from your local utility company. | Check your utility’s website or look at historical rate data. A conservative estimate is 2-4% annually. |

Once you have these numbers, you can start to see the full picture. It’s not just about today’s savings, but about future-proofing your finances.

The Big Picture: Beyond The Numbers

Soaring Utility Rates: Let’s face it, electricity prices rarely go down. They almost always climb over time. When you generate your own power with solar, you essentially lock in your energy costs, protecting your household budget from those unpredictable rate hikes. Your savings actually grow larger every year the utility company raises its prices.

Valuable Incentives: Governments at all levels want to encourage homeowners to go solar. This means you can often access tax credits, rebates, and other programs that can slash your initial investment, which gives your ROI a massive boost right from the start.

System Costs: Of course, the initial price tag is a huge part of the equation. Getting a clear idea of how much solar panels cost in your area is the first step to building an accurate financial forecast.

On average, the ROI for solar panels in the U.S. lands around 10%, but this figure can swing wildly depending on where you live. Your local electricity rates, how much sun your roof gets, and the incentives available in your state all play a major role. With most solar panels designed to last for 25 years or more, you're locking in decades of substantial savings.

A solar ROI calculator does more than just tell you when you’ll break even. It’s a forecasting tool that shows you how an initial investment can pay for itself and then continue to generate real financial value for years to come.

This approach gives you a complete view of how a solar system goes from an upfront cost to a profitable, long-term asset. It's about empowering you to make a decision based on solid financial data, not just guesswork.

Getting Your Numbers Straight for a Solid Solar ROI

Any solar calculator is only as good as the numbers you plug into it. The old saying "garbage in, garbage out" has never been more true. To get a realistic picture of your solar return on investment, you'll need to do a little bit of homework first. It's not complicated, but getting these details right is the key to a forecast you can actually trust.

First things first: you need the total system cost. This isn't a ballpark figure you find online. It's the "all-in" price from a detailed, professional quote. This number needs to include everything—the panels, inverters, racking, labor, permits, and any electrical upgrades. A formal quote is your only true starting point.

With that in hand, it's time to dig into your current energy habits.

Know Your Electric Bill Inside and Out

Go find your last 12 months of utility bills. Most power companies make this easy by showing an annual summary right on the bill or online portal. If not, you’ll have to add up the monthly kilowatt-hours (kWh) yourself. This gives you a clear baseline of your home's energy appetite through all four seasons.

From there, you can figure out your average cost per kWh. Just divide your total electricity cost for the year by the total kWh you used. This single number is the bedrock for calculating just how much money solar will save you each month.

The cost of electricity varies wildly depending on where you live, which has a huge impact on how quickly you'll break even on your solar investment.

As you can see, someone in a high-cost state like California is going to see a much faster payback period than a homeowner in a state with cheaper utility rates.

Don't Leave Money on the Table: Find Your Incentives

This is the fun part, where that initial sticker price starts to shrink. Financial incentives are a massive piece of the ROI puzzle and are designed to make going solar much more accessible. You need to track down every single credit and rebate you qualify for.

- Federal Solar Tax Credit: This is the big one. The Residential Clean Energy Credit lets you slash your federal tax bill by a percentage of your total system cost. For now, that's a whopping 30%.

- State and Local Rebates: Dig into what your state, city, or even your specific utility company offers. These programs can knock hundreds or even thousands of dollars off your cost, either as a direct rebate or an additional tax credit.

- Performance-Based Incentives (PBIs): In some areas, you can earn and sell Solar Renewable Energy Certificates (SRECs) for the clean power your system generates. It's literally a way to get paid for producing electricity.

Getting these three data points locked down—your total system cost, your average energy cost, and every available incentive—is the absolute foundation for an accurate ROI. If you guess or use vague estimates, you’ll end up with a financial forecast that's just as fuzzy.

Once you have a solid handle on how much energy you actually use, you can start thinking about the right-sized system for your home. To get this part right, our guide on using a solar system sizing calculator is the perfect next step. It'll help you match your needs to the right equipment so you don't end up with a system that's too big or, even worse, too small.

How to Calculate Your Solar ROI

So, you’re ready to run the numbers and see what a solar investment could really do for your finances. Let's walk through how to calculate your solar return on investment (ROI) without getting bogged down in complex spreadsheets. The aim here is to paint a realistic financial picture, not just a simple payback period.

At its core, the calculation is a balancing act: what you spend versus what you gain over the life of the system. This means we have to look well beyond the first year and project the value you’ll get over two decades or more. We'll need to pull together your total energy savings, the boost you get from incentives, and your all-in costs to see the full story.

The Core Solar ROI Formula

To figure out your ROI, you just need to see how these financial pieces fit together. The formula most folks in the industry use is pretty straightforward: ROI = [(Total Energy Savings + Incentives) – Total Costs] / Total Costs × 100.

Your "total energy savings" are what you won't be paying the utility company over the system’s lifespan, which is typically 25 to 30 years. The "total costs" include the equipment and installation. Finally, "incentives" cover game-changers like the 30% federal tax credit and any state or local rebates you can claim.

It's also worth noting that small upgrades can make a big difference. For instance, things like solar panel power optimizers can squeeze more energy out of your system, which directly boosts your long-term profitability and improves your final ROI numbers.

Factoring in Real-World Variables

A basic calculation is a great starting point, but an accurate forecast needs to account for how things change over time. Two critical variables that often get overlooked are panel degradation and rising utility rates.

- Panel Degradation: Solar panels aren't immune to aging. They lose a tiny bit of their efficiency every year, usually around 0.5%. It’s a small number, but over 25 years, it adds up. Factoring this in gives you a more conservative—and realistic—projection of your long-term savings.

- Utility Rate Inflation: On the other hand, electricity prices almost never stand still. They go up. A historical average increase of 2-4% per year is a pretty safe bet. This means the value of the energy you produce will actually grow each year, compounding the returns on your investment.

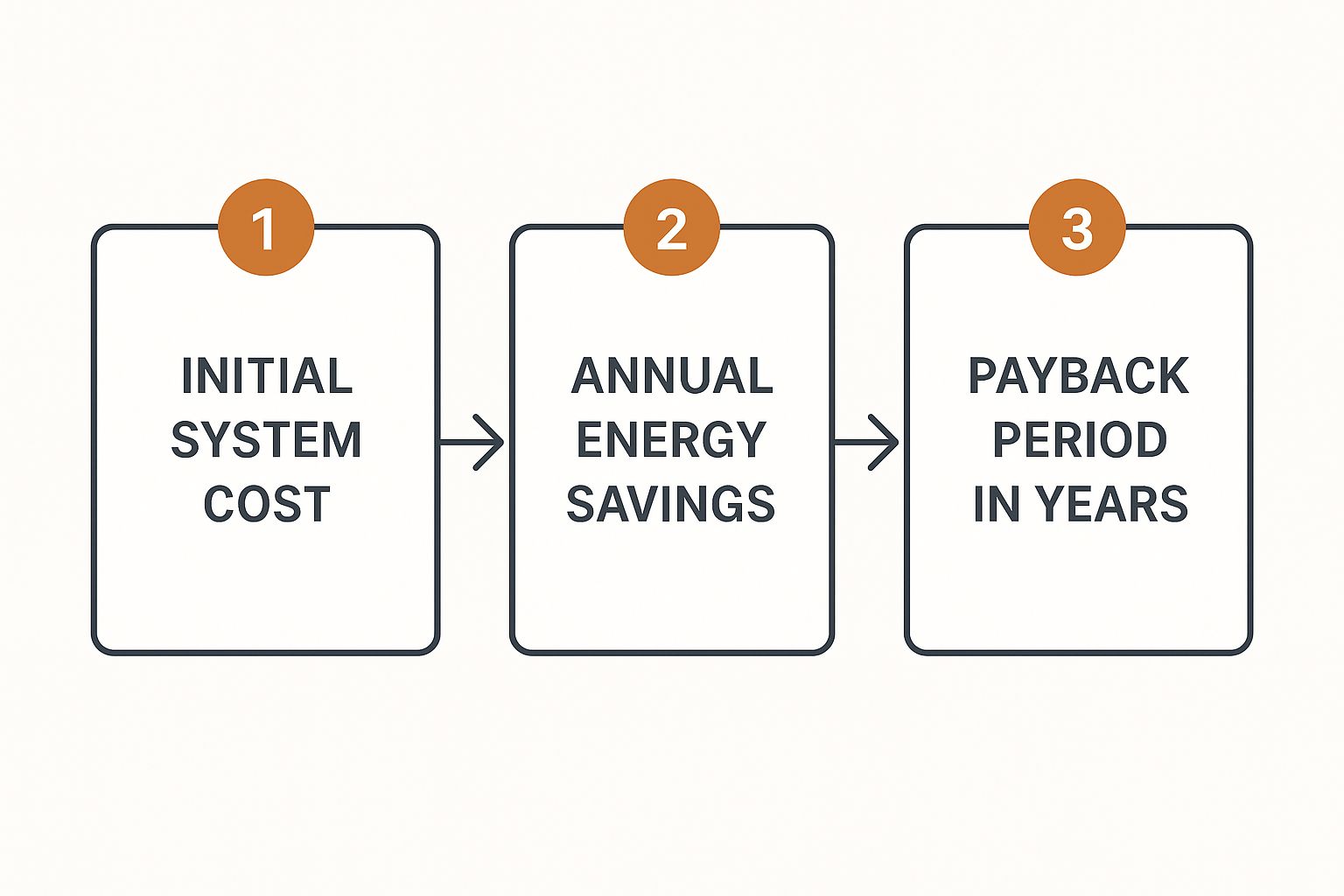

This image really helps visualize how the money flows, from your initial cost to the eventual payback.

Seeing it laid out like this makes it clearer how those upfront costs are chipped away by annual savings until you hit that break-even point and start banking pure profit.

Let's put this into a quick, real-world scenario. Imagine your new system costs $20,000 and is projected to save you $1,800 on electricity in its first year.

First, you'd adjust for that slight dip in efficiency. In year two, your savings might be a little less, maybe around $1,791 (which is just $1,800 x 0.995).

But then you account for the utility company raising its rates. If their prices jump by 3%, that $1,791 worth of electricity is now valued at $1,844. Your savings went up!

When you apply these competing forces year after year, you get a much more dynamic and accurate financial picture than a simple payback calculation could ever provide.

The Solar ROI Formula:

ROI % = (Lifetime Financial Gain – Final System Cost) / Final System Cost

Where "Lifetime Financial Gain" is your total energy savings plus all incentives, and "Final System Cost" is your initial price tag minus those same incentives.

Let's Look at a Real-World Solar ROI Example

Formulas on a page are one thing, but seeing how the numbers shake out for an actual homeowner is where it all starts to make sense. Let's run through a practical case study to see how a solar ROI calculator turns abstract concepts into a clear financial picture.

For this example, we’ll head to sunny Arizona—a place where solar panels can really shine. A pretty standard residential system there is about 7.2 kW, which is plenty of power for the average family home.

Breaking Down the Numbers in Arizona

First things first, let's talk about the upfront investment. A 7.2 kW system like this typically has a gross installation cost of around $24,000 before any incentives kick in.

But right off the bat, you get a huge break from the 30% federal tax credit. This isn't just a deduction; it’s a direct credit that slashes your tax bill by $7,200, which is a massive win for the homeowner.

Now, for the fun part—the savings. In a prime location like Arizona, that 7.2 kW system will generate roughly 12,500 kWh of electricity each year. With the local utility charging an average of $0.17 per kWh, that translates to about $2,125 in energy savings in the very first year. For a deeper dive into the math, check out this excellent guide to calculating solar panel ROI.

Pinpointing your first-year ROI is a key milestone. It sets the baseline for your entire investment, showing you the immediate financial impact of switching to solar power.

With these initial figures, we can already start to see how quickly this investment will pay for itself.

To make it even clearer, here’s a step-by-step summary of the financials for our Arizona homeowner.

Arizona Case Study Financial Breakdown

| Financial Metric | Calculation | Result |

|---|---|---|

| Gross System Cost | Initial price for a 7.2 kW installation | $24,000 |

| Federal Tax Credit | $24,000 x 30% | -$7,200 |

| Net System Cost | $24,000 – $7,200 | $16,800 |

| Annual Energy Savings | 12,500 kWh produced x $0.17/kWh | $2,125 |

| Payback Period | $16,800 / $2,125 per year | ~7.9 Years |

As you can see, the path to breaking even is surprisingly short. Once that payback period is over, the real financial benefits begin to accumulate.

Calculating the Payback and Long-Term Profit

The payback period is where the investment truly flips from a cost to an asset. To find it, we just divide the net cost by the annual savings. In our Arizona example, that’s $16,800 (the net cost after the tax credit) divided by $2,125 in yearly savings.

The result? A payback period of just 7.9 years. Think about that—in less than eight years, the solar panels have completely paid for themselves.

From that moment on, every bit of energy the system produces is pure profit. The chart you saw earlier shows this perfectly. You can see the savings line cross the break-even point and then shoot upward over the system's 25-year lifespan. By the end of its life, this single investment will have put tens of thousands of dollars back into the homeowner's pocket. It’s a powerful financial move, not just an environmental one.

Beyond ROI: The Long-Term Value of Solar

A solar ROI calculator is an incredible tool for figuring out your payback period. It gives you the hard numbers. But honestly, the real, lasting value of switching to solar energy goes so much deeper than what a spreadsheet can ever capture.

These are the benefits that don't always have a neat dollar sign next to them but have a massive impact on your home's worth and your family’s financial stability for years to come.

One of the biggest wins is the immediate boost to your home's resale value. Time and time again, studies have shown that homes with solar panels sell for a significant premium compared to similar homes without them. Today’s buyers are smart, and they’re actively looking for homes with predictable, low energy costs baked right in.

Think about it. You get paid back every month through lower bills, and you get paid back again when it’s time to sell. That's a powerful financial asset most ROI calculations completely ignore.

Achieving True Energy Independence

Another huge advantage is the feeling of energy independence. When you’re generating power on your own roof, you’re no longer just a passive customer of the utility company, subject to their next rate hike. You're essentially running your own personal power station.

This gives you a powerful buffer against the volatile energy market.

And that independence brings real peace of mind. If the grid goes down, a solar system paired with a battery backup can keep your lights on, your refrigerator running, and your family safe. It's a layer of security that you can't really put a price on—until you’re the only house on the block with power.

The long-term value of solar lies in its ability to provide financial stability, increase property value, and secure your energy future—benefits that compound long after the initial investment is paid off.

Of course, to get the most out of your system for decades, you need to think about upkeep. Simple maintenance like regular solar panel cleaning ensures your panels are always working at their best, which is critical for maximizing that long-term value. If you're curious about the system's longevity, our guide on https://radiantenergysolar.com/how-long-do-solar-panels-last/ is a great resource.

Your Contribution To A Cleaner Future

Finally, let's talk about the environmental impact, because for many people, this is a huge part of the equation.

Choosing solar is a direct, tangible way to invest in a healthier planet. Every bit of clean energy your panels generate is energy that doesn't have to come from a fossil-fuel-burning power plant. You're actively reducing your family's carbon footprint and helping create cleaner air for your entire community.

This benefit is both personal and profound. While the calculator is busy crunching the financial numbers, the satisfaction you get from powering your life with clean energy is a return on investment all its own.

Common Questions About Solar ROI

Even after running the numbers through a great solar ROI calculator, it's totally normal to have a few questions pop up. Let's dig into some of the most common ones I hear from homeowners, so you can feel solid about your financial analysis and the final decision you make.

How Accurate Are These Calculators, Really?

This is usually the first thing people ask, and it's a fair question. The truth is, a calculator's forecast is only as good as the data you feed it. If you plug in accurate numbers for your system's cost, your actual energy usage, and the rates on your current utility bill, the results can be incredibly reliable.

But it's still an estimate, right? Yes. The calculator has to make some educated guesses about the future, especially when it comes to things like rising utility rates and how much the panels will degrade over time. The best tools use industry-standard figures to keep things realistic—usually a 2-3% annual hike in electricity prices and a very gradual 0.5% yearly drop in panel efficiency.

What’s the Difference Between ROI and the Payback Period?

I see these terms get mixed up all the time, but they tell you two very different—and equally important—things about your solar investment. Getting the distinction right is key to seeing the full picture.

- Payback Period: This is all about time. It's simply how long it takes for your energy savings to completely cover the initial cost of the system. If you have a 9-year payback period, you've officially broken even after nine years.

- Return on Investment (ROI): This is about total profit. ROI measures how much money the system generates over its entire life, which is typically 25 years. It’s shown as a percentage of your original investment.

Think of it this way: a system might have that 9-year payback, but it could go on to deliver a 160% ROI over its full lifespan. The payback period tells you when you get your money back. The ROI tells you how much money you actually make in the long run.

This chart makes it easy to see. The payback period is just that one point in time where the line crosses from negative to positive. The ROI is all the green space above the line for the next decade and a half.

Breaking even is a great milestone, but it’s really just the beginning of the financial benefits.

Should I Factor in Maintenance Costs?

Yes, absolutely. For the most conservative and realistic projection, you should account for potential maintenance. Modern solar panels are built like tanks and usually just need a cleaning now and then, but nothing is completely maintenance-free for 25 years.

The big-ticket item to plan for is the inverter. It's the hardworking heart of your system, and its warranty is often shorter than the panels'—usually around 10 to 15 years. That means you'll likely need to replace it at least once.

Pro Tip: When you're using a solar ROI calculator, you can handle this in one of two ways. You can either add a small annual maintenance budget (say, 1% of the total system cost per year) or just budget for one full inverter replacement around year 15. This builds a buffer into your numbers and prevents any surprise costs from derailing your fantastic ROI.

Tackling these questions head-on helps you move forward with a clear, realistic view of your solar investment. It's all about making a decision based on solid data, not just hope.

Ready to see what your personal solar ROI looks like? The team at Radiant Energy can provide a detailed, no-obligation quote and walk you through a personalized financial analysis. Start your solar journey today!