So, what’s the real bottom line when it comes to putting solar panels on your roof? While the final number can shift, the typical cost of residential solar panels falls somewhere between $15,000 and $35,000 before you factor in any tax breaks or incentives.

That initial sticker price might seem high, but the 30% federal tax credit dramatically changes the equation, bringing solar within reach for a lot more homeowners.

The True Price of Going Solar for Your Home

Figuring out the upfront investment is always the first step. It's important to remember that the total price isn't just about the panels themselves. You're also paying for the professional installation, critical hardware like inverters that convert solar energy into usable electricity, and all the necessary permits to get your system legally connected to the grid.

Recent industry data shows a pretty consistent range. A standard home system with about 20 to 30 panels usually costs between $24,000 and $36,000 before that big federal tax credit kicks in. For most folks, the all-in price lands somewhere from $25,000 to $50,000, depending on how big the system is, where you live, and which installer you choose. You can always dig into more detailed cost breakdowns to see how these numbers stack up across the country.

To make things a bit clearer, let's break down the average costs for the most common system sizes and see how that all-important tax credit makes a difference.

Average Residential Solar Panel Cost at a Glance

Here’s a quick snapshot of what you can expect to pay for different-sized residential solar systems. The chart shows the total cost before any incentives and then the estimated cost after applying the 30% federal tax credit.

graph TD

subgraph Cost Comparison by System Size

A[6 kW<br>$18,000<br>($12,600 After Credit)]

B[8 kW<br>$24,000<br>($16,800 After Credit)]

C[10 kW<br>$30,000<br>($21,000 After Credit)]

D[12 kW<br>$36,000<br>($25,200 After Credit)]

end

style A fill:#f9f,stroke:#333,stroke-width:2px

style B fill:#ccf,stroke:#333,stroke-width:2px

style C fill:#bbf,stroke:#333,stroke-width:2px

style D fill:#9cf,stroke:#333,stroke-width:2px

These numbers give you a solid ballpark to start with. They show just how much of a game-changer that federal incentive really is.

Keep in mind: The federal tax credit is a dollar-for-dollar reduction of the income tax you owe. So, for a $30,000 system, that's a $9,000 credit that comes directly off your tax bill, which is way more powerful than a simple deduction.

With this financial overview in hand, we can now look at the specific details—like the condition of your roof or the brand of equipment you select—that will ultimately determine the final price tag for your home's solar panel system.

Breaking Down Your Solar Installation Costs

When people ask about the price of a solar installation, it’s a lot like asking how much it costs to build a custom car. There's no single answer because it’s not just about the engine. The total investment is a mix of several crucial parts, and each one affects the system's performance, lifespan, and your final bill. Let's pull back the curtain on the cost of residential solar panels.

The first thing that shapes the price is the system's size, which we measure in kilowatts (kW). This isn't just a number pulled out of thin air; it’s calculated based on your home's unique energy appetite. A sprawling home with a heated pool and an EV charger in the garage will need a much beefier—and therefore more expensive—system than a smaller, super-efficient house.

Core Hardware: The Panels and Inverters

Once your ideal system size is determined, the conversation turns to the hardware. The solar panels are the star of the show, but they're not all the same. Sticking with our car analogy, this is where you choose your engine.

- Monocrystalline Panels: Think of these as the high-performance option. They're crafted from a single, pure silicon crystal, making them more efficient and giving them that sleek, uniform black look. That premium performance, however, comes with a higher price tag.

- Polycrystalline Panels: This is the more budget-friendly route. Made from melted silicon fragments, they're a little less efficient and have a recognizable blue, marbled appearance. They get the job done but might take up more roof space to produce the same amount of power.

Just as critical is the inverter—the real brain of the operation. This device is responsible for converting the direct current (DC) electricity your panels generate into the alternating current (AC) that powers your home.

Key Takeaway: Choosing your hardware is a classic trade-off. High-efficiency components usually mean a bigger upfront investment, but they can pay you back with better long-term performance and savings, which is especially important if you're working with limited roof space.

The "Soft Costs": Labor and Everything Else

It might surprise you to learn that the actual hardware often makes up only about 40-50% of the total project cost. The other half is what we in the industry call "soft costs." These are the essential, behind-the-scenes expenses that take your project from an idea to a fully functioning system on your roof.

pie

title Solar Project Cost Breakdown

"Hardware (Panels, Inverters)" : 45

"Soft Costs (Labor, Permits, Design)" : 55

This broad category covers several vital pieces:

- Labor: This is what you pay the certified electricians and professional installers who handle the physical work of mounting the panels and wiring everything together.

- Permitting: Your town or city requires official permits to ensure the job is done safely and up to code. These permits have fees attached.

- Engineering and Design: A solar professional creates a custom blueprint for your home, figuring out the best way to maximize your roof's solar potential.

- Interconnection Fees: This is a fee charged by your utility company to formally connect your new solar system to the electrical grid.

These soft costs can fluctuate quite a bit depending on where you live, how complex your roof is, and the going rates for skilled labor in your area. To dive deeper, you can explore our full guide to understanding the solar panel system installation cost.

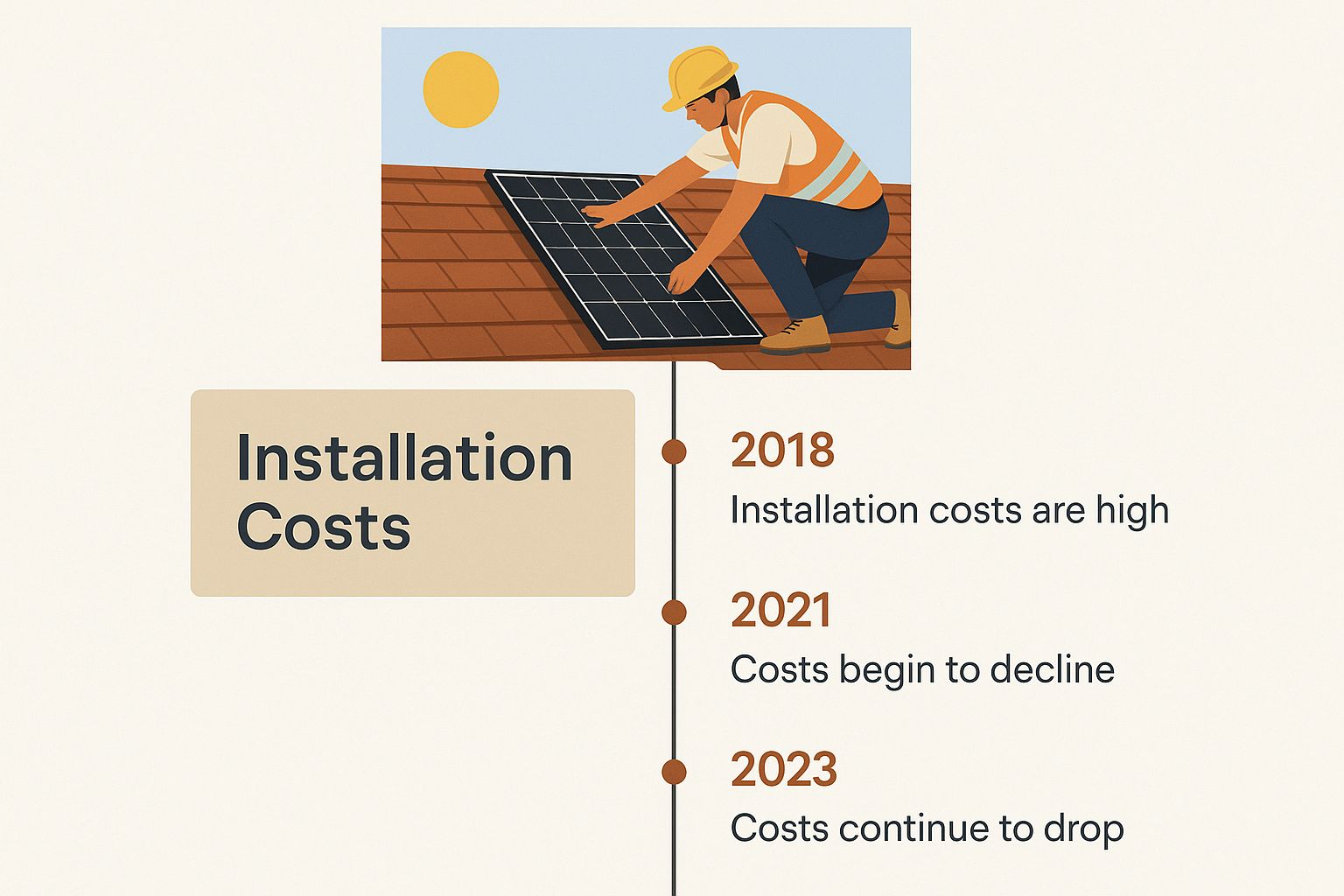

How Solar Became an Affordable Home Upgrade

To really get why today's solar panel prices are such a big deal, you have to look back. It wasn't that long ago that solar power was something you'd see on a satellite, not your neighbor's roof. The journey from a wildly expensive, niche technology to a smart home upgrade is a story of incredible progress.

The main reason for this shift? A massive, decades-long price drop. What was once an out-of-reach luxury is now a sound financial move for millions. This didn't just happen; it’s the result of relentless innovation and fierce competition in the solar industry.

The Incredible Price Plunge

The numbers tell the most powerful story here. The standard industry metric is cost per watt, and over the last 50 years, that cost hasn't just dropped—it's fallen off a cliff.

Back in the 1970s, putting solar on a house was practically science fiction, with panels costing an eye-watering $76 per watt. Fast forward to 2010, and the price had already tumbled to around $7.50 per watt. Today, we're looking at an average of just $1 per watt. This is the single biggest reason solar is now a real option for everyday homeowners. For a deeper dive into this trend, you can learn more about the evolution of solar panel costs.

The chart below really puts this 50-year journey into perspective, showing just how dramatically prices have fallen from one decade to the next.

xychart-beta

title "The Falling Cost of Solar Panels (Avg. Cost per Watt)"

x-axis [1970s, 1980s, 1990s, 2000s, 2010s, 2020s]

y-axis "Cost per Watt ($)" [0, 20, 40, 60, 80]

bar [76, 30, 10, 8.5, 7.5, 1]

As you can see, the price didn't just slowly trickle down; it plummeted, especially in the last 20 years. This rapid acceleration is what opened the floodgates for residential solar adoption.

This visual timeline really drives the point home. The most dramatic cost reductions have happened recently, making today's market a fantastic opportunity for homeowners.

Why the Big Drop? Think of it like the first flat-screen TVs. They were bulky, insanely expensive, and only a few people had them. But as manufacturing got smarter and more companies jumped in, the quality shot up and the prices came way down. Solar followed that exact same playbook.

What Made Solar So Much Cheaper

It wasn't just one thing, but a perfect storm of factors that drove down the cost of solar panels and turned them into a practical investment.

- Smarter Manufacturing: Scientists and engineers figured out how to produce the core components—silicon wafers—more cheaply and efficiently. As factories got bigger and more automated, the cost to make each individual panel dropped significantly.

- More Powerful Panels: Today's panels are workhorses compared to their predecessors. A modern panel squeezes far more electricity out of the same sunlight, which means you need fewer of them to power your home, cutting down on the total system cost.

- Global Competition: As solar caught on, companies all over the world started making panels. This influx of supply and competition put pressure on everyone to lower their prices to win over customers like you.

This history lesson isn't just for trivia night; it gives you important context. The affordable price of solar today isn't some temporary sale—it's the result of 50 years of progress. That long-term, consistent trend is a strong signal that now is one of the best times ever to invest in solar for your home.

Using Incentives to Lower Your Solar Costs

Let’s talk about one of the biggest misconceptions in solar: the sticker price. The initial quote you get for a new solar system is almost never what you’ll actually end up paying. Think of it more as a starting line.

A whole network of federal, state, and even local programs is in place specifically to knock that price down. These incentives are designed to make the cost of residential solar panels much more manageable for the average homeowner.

The biggest game-changer is the Federal Solar Investment Tax Credit, often just called the ITC. This isn't some tiny rebate; it's a massive, dollar-for-dollar credit that directly reduces what you owe in federal income taxes. For any system installed between 2022 and 2032, you can claim a credit for 30% of the total system cost.

On a typical $30,000 solar installation, for example, the ITC gives you a $9,000 credit. That’s nine grand you don’t have to send to the IRS, which effectively slashes the system’s real cost by nearly a third. It’s a huge part of why solar has exploded in popularity across the country.

Stacking Your Savings Beyond the Federal Credit

While the federal ITC is the foundation of your savings, the story doesn't end there. The financial picture gets even brighter when you start layering on incentives from your state and local utility.

These programs vary wildly depending on where you live, but they can dramatically lower your out-of-pocket costs. They usually fall into a few different buckets:

- State Tax Credits: Some states offer their own version of the ITC, giving you an additional credit to apply to your state income tax bill.

- Cash Rebates: This is as straightforward as it gets. Your state or utility company might offer a direct cash-back payment after your system is installed, often based on its size.

- Performance-Based Incentives (PBIs): In certain areas, you can actually earn money for the power your panels generate. Through programs like Solar Renewable Energy Certificates (SRECs), you generate a certificate for every megawatt-hour of clean energy you produce, which you can then sell on an open market.

The trick is knowing what’s available in your specific zip code. A good local solar installer is your best friend here—they’ll know every single incentive you qualify for and can map out exactly how much each one will save you.

A Real-World Incentive Scenario

So, how does this all come together in practice? Let's walk through an example. Imagine you’re installing a $30,000 solar system in a state that also offers a $1,000 rebate.

graph TD

A[Start: Gross Cost<br>$30,000] --> B(Subtract State Rebate<br>-$1,000);

B --> C{Adjusted Cost<br>$29,000};

C --> D(Calculate Federal Credit<br>30% of $29,000 = -$8,700);

D --> E[Finish: Final Net Cost<br>$20,300];

style A fill:#f96

style E fill:#9c9

Just like that, by stacking a single state incentive with the federal credit, you’ve saved $9,700. That’s a total cost reduction of over 32%.

And don't forget to look beyond solar-specific programs. You might qualify for other home improvement benefits, too. It’s always worth looking into general tax credits and incentives for home improvements to see if you can save even more.

Finding the Right Way to Finance Your System

You don’t need a pile of cash sitting in the bank to go solar. For most homeowners, the high upfront cost of residential solar panels is the biggest roadblock, but there are plenty of ways to make it happen without draining your savings. The trick is simply finding the path that lines up with your financial goals.

The most common routes are solar loans, solar leases, and Power Purchase Agreements (PPAs). Each one works a little differently, especially when it comes to who owns the equipment, who handles maintenance, and how you save money over the long haul. Getting a handle on these differences is the first step toward making a smart investment in your home's energy future.

Solar Loans: The Path to Ownership

A solar loan is about as straightforward as it gets—you borrow money to buy your solar panel system outright, much like you would for a car. This is the only financing route where you own the system from day one.

Because the panels are yours, you’re the one who gets to claim the valuable federal tax credit and any other state or local incentives. This is a huge perk that can shave thousands off your net cost and seriously speed up your return on investment.

While a solar loan can add $3,000 to $8,000 in interest over its lifetime, the monthly payments are often less than what you were already paying the utility company. So, you start saving immediately.

The Big Win: With a loan, your predictable monthly payment replaces your old, fluctuating electric bill. Once the loan is paid off, you get free electricity for the remaining life of the system—often another 15-20 years.

Beyond standard financing, some homeowners look into government-backed renovation programs like FHA 203(k) loans, which let you roll the cost of home improvements right into your mortgage.

Solar Leases and PPAs: An Alternative Approach

What if you want the benefits of solar without the loan or the responsibilities of ownership? A solar lease or a PPA might be the perfect fit. In both cases, a third-party company installs, owns, and maintains the solar panels on your roof. You just pay to use the clean power they generate.

Here’s the basic breakdown:

- Solar Lease: You pay a fixed monthly "rent" to the solar company for having the equipment on your roof.

- Power Purchase Agreement (PPA): Instead of a fixed rent, you agree to buy the electricity produced by the panels at a set rate per kilowatt-hour, which is almost always lower than your utility's rate.

These options are incredibly popular because they usually require little to no money down. The trade-off, however, is that the solar company owns the system, so they are the ones who claim all the tax credits and other incentives.

For a complete comparison, check out our guide on the differences between a solar lease vs PPA.

Calculating Your Return on a Solar Investment

It’s easy to get bogged down in the upfront cost of residential solar panels, but the real conversation is about long-term value. When you start to calculate the return on investment (ROI) and the payback period, you begin to see a solar system for what it truly is: not just another home expense, but a powerful financial asset.

To figure this out, we just need to look at three key numbers. First, what’s your net upfront cost after all the tax credits and rebates are factored in? Second, how much will you save on electricity each year? And finally, will you earn any extra income from programs like Solar Renewable Energy Certificates (SRECs)?

Breaking Down the Payback Period

The payback period is simply the amount of time it takes for your solar panels to completely pay for themselves through energy savings. Once you hit that milestone, every bit of electricity your system generates is pure profit, putting money back in your pocket instead of sending it to the utility company.

Let's walk through a quick, real-world example to make this crystal clear:

- Net System Cost: Imagine your system costs $25,000. The 30% federal tax credit immediately knocks $7,500 off that, bringing your actual cost down to $17,500.

- Annual Electricity Savings: You were paying about $150 per month for power, which adds up to $1,800 per year. Your new solar system completely wipes out that bill.

- Calculate the Payback: Now, just divide your net cost by your annual savings: $17,500 / $1,800 = 9.7 years.

In this scenario, your solar panels would pay for themselves in under 10 years. For the next 15-20+ years of the system's life, you get free electricity, all while being completely insulated from the utility company's inevitable rate hikes.

This straightforward math shows how a smart investment can quickly become a wealth-building tool. If you want to see what this looks like with your own numbers, our solar return on investment calculator can give you a personalized estimate.

And remember, the benefits don't stop at your electric bill. A solar installation also adds significant value to your home, making it a wise financial decision from every angle.

Still Have Questions About Solar Costs?

Even after breaking down the numbers and incentives, it's natural to have a few lingering questions. Let's tackle some of the most common concerns homeowners bring up before going solar.

Are Solar Panels Expensive to Maintain?

Honestly, not really. Solar panels are built like tanks—they have no moving parts and are designed to withstand the elements for decades. Because of this, their maintenance needs are surprisingly low.

For the most part, you just need to keep them clean. A bit of dust, pollen, or a few leaves can build up over time and slightly reduce how much sunlight they absorb. In most climates, a quick spray with a garden hose a couple of times a year is all you'll ever need to do.

The one major component you might need to think about down the road is the inverter, which typically needs replacing every 10-15 years. But the panels themselves? They're incredibly reliable and almost always come with a 25-year performance warranty. This makes long-term upkeep costs a very small piece of the financial puzzle for most homeowners.

The takeaway here is that modern solar systems are pretty much a 'set it and forget it' technology. The minimal maintenance required is just a tiny fraction of the overall lifetime cost.

Will My Property Taxes Go Up After Installing Solar?

This is a fantastic question, and for many people, the answer is a welcome surprise: no. It's true that adding solar panels increases the value of your home, but a lot of states have property tax exemptions specifically for renewable energy systems.

This is a deliberate incentive designed to encourage homeowners to switch to solar. You get all the benefits of a more valuable home without the downside of a bigger tax bill. Of course, you should always double-check the specific regulations in your state and city, but this is a very common and powerful perk.

How Much Does Solar Cost in Other Countries?

While the cost of solar technology has been dropping globally for years, local prices can be a totally different story. It's a perfect example of how regional factors can create some surprising differences.

For example, some UK solar panel prices in 2024 were actually higher than they were a decade ago. This really highlights how things like local labor costs, specific government programs, and supply chain issues can dramatically affect the final price tag for a homeowner. If you're curious, you can discover more insights about solar panel statistics on whatcost.co.uk.

This is exactly why it's so crucial to get quotes from local installers. They're the ones who truly understand the unique cost landscape in your specific area.

Ready to see how much you could save with a custom solar solution? The experts at Radiant Energy can provide a free, no-obligation quote tailored to your home and energy needs. Get your personalized solar estimate today!