When you're looking to go solar without a hefty upfront investment, you'll inevitably run into two popular options: a solar lease and a Power Purchase Agreement (PPA). At first glance, they seem similar—both get panels on your roof for little to no money down. But the real difference, the one that impacts your wallet every month, is how you pay for the electricity.

A solar lease is straightforward: you pay a fixed monthly fee to rent the equipment, much like leasing a car. A PPA, on the other hand, means you only pay for the actual power the system generates, tying your bill directly to the sun.

Understanding Solar Lease vs. PPA Basics

Choosing between a lease and a PPA is a common crossroads for homeowners. Both paths let you tap into solar energy without the initial financial hit of buying a system outright. The right choice really boils down to your personal finances and whether you prefer predictable bills or payments that mirror your system's performance.

Core Differences at a Glance

If you love budget certainty, a solar lease is your friend. You pay the exact same amount month after month, whether it's a long, sunny summer day or a cloudy winter afternoon. It's perfect for anyone who wants to set their utility budget and forget it.

A PPA works differently, linking your payments directly to the system's output. You agree to a specific rate per kilowatt-hour (kWh), so your bills will naturally be higher during those sunny months when the panels are cranking out power and lower when production dips. Your costs directly reflect the energy you’re getting.

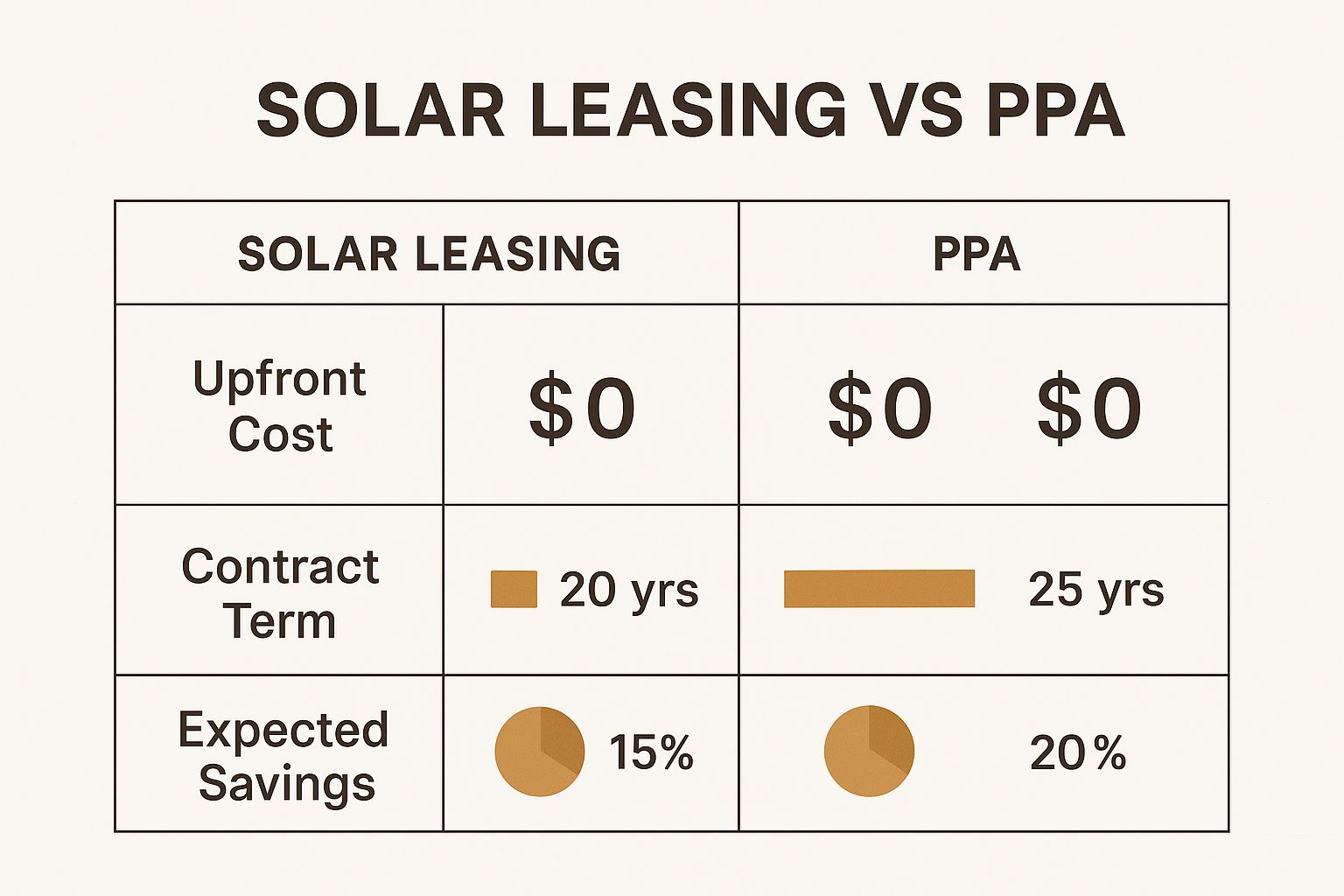

This visual gives a great breakdown of how the costs, contract terms, and potential savings stack up for each option.

As the infographic points out, while both options get you started with zero down, PPAs often have a slight edge in potential long-term savings because your costs are tied to actual energy production.

The payment model is what truly sets them apart. With a lease, you might have a $96.60 monthly payment locked in, no matter what. With a PPA at a rate of, say, $0.15/kWh, your bill fluctuates. Interestingly, over a full year, both scenarios could end up costing you roughly the same for the 7,728 kWh of solar power produced. For a deeper dive into these payment models, the folks at EnergySage.com have a great comparison.

Lo más importante: Think of it this way: with a solar lease, you're paying to rent the equipment. With a PPA, you're paying for the power that equipment produces.

To make things even clearer, let's look at a quick side-by-side comparison of how these two popular financing options work in the real world.

Core Differences Solar Lease vs PPA

This table gives you a quick summary of the fundamental differences between leasing solar panels and signing a PPA.

| Característica | Solar Lease | Solar PPA (Power Purchase Agreement) |

|---|---|---|

| Payment Structure | Fixed monthly payment | Variable monthly payment based on kWh production |

| Coste inicial | Typically $0 | Typically $0 |

| System Ownership | The solar company owns the system | The solar company owns the system |

| Maintenance | Included and handled by the solar company | Included and handled by the solar company |

| Lo mejor para | Homeowners who prefer predictable, consistent bills | Homeowners comfortable with variable bills that reflect energy output |

Ultimately, both are solid ways to get into solar without the purchase price, but the best fit depends entirely on your financial comfort zone.

Breaking Down the Financial Commitments

When you’re looking at going solar without buying the panels outright, you'll run into two main options: a solar lease and a Power Purchase Agreement (PPA). On the surface, they seem similar, but how you pay for the power makes all the difference in your long-term financial picture. Both paths get you solar energy, but they're built for different financial comfort levels over the typical 20 to 25-year contract.

Think of a solar lease like leasing a car. You agree to a flat, fixed monthly payment for the use of the equipment. That payment stays the same whether it's a blazing hot July or a gloomy December. It's all about predictability, which makes household budgeting a breeze.

A PPA, on the other hand, is a bit more dynamic. Instead of paying for the panels, you’re paying for the power they generate. You agree to a set price per kilowatt-hour (kWh), so your bill fluctuates with the seasons. You'll pay more during those long, sunny summer months and less in the winter when the sun is scarce.

Unpacking the Solar Lease Payment Model

The biggest draw of a solar lease is its straightforward, predictable cost. You’ll typically see fixed monthly payments land somewhere between $100 to $250, and that price is locked in for the entire 20 to 25-year term. This consistency is a huge relief for anyone who's tired of surprise spikes in their utility bills. It offers a stable energy expense you can count on for decades.

But there's a crucial trade-off. The solar company that owns the system gets to claim the valuable federal solar Investment Tax Credit (ITC), not you. Because you're just renting the equipment, you miss out on this significant financial perk, which can reduce the total lifetime savings compared to owning. This is a key detail to understand; as this solar financing comparison from ConsumerAffairs.com explains, leasing is more about immediate savings than building a long-term asset.

Analyzing the PPA Rate Structure and Escalators

With a PPA, your savings are tied directly to the sun. You can expect to save between 10% and 30% on your energy costs, but your monthly bill is a moving target. This pay-as-you-go model feels fair to many homeowners—you only pay for the electricity the system actually produces.

However, you have to read the fine print for something called an escalator clause. This is a standard feature in most PPA contracts that allows the provider to raise your per-kWh rate by a small amount each year, usually between 1% and 3%. It might not sound like much, but over two decades, that slow creep can really add up, potentially shrinking the savings gap between your solar rate and the utility's rate.

Let's look at how this plays out over 20 years with a hypothetical comparison. This chart shows how the initial appeal of a lower PPA payment can fade as the escalator kicks in year after year.

Financial Insight: Always zero in on the escalator clause in a PPA. A lower rate—or better yet, a contract with no escalator at all—is your best bet for maximizing long-term savings.

Ultimately, your choice boils down to what you value more. Do you want the unwavering financial stability of a lease? Or are you comfortable with a variable bill that’s tied to performance, even with the risk of rising rates? Neither option gets you an asset you own, but both can effectively lower your electricity costs from day one.

Navigating Ownership and Contract Terms

When you're looking at a solar lease or a Power Purchase Agreement (PPA), it's easy to focus just on the monthly savings. But what you’re really doing is signing a long-term contract, and the details of that agreement matter—a lot. Let's get one thing straight from the start: with either a lease or a PPA, you do not own the solar panel system on your roof.

The solar company owns it, and they are responsible for it. This is the core of the "solar-as-a-service" model. They handle all the maintenance, repairs, and monitoring for the entire life of the contract, which is typically De 20 a 25 años. If an inverter goes on the fritz or a panel stops working, it’s their problem to solve, not yours. That means no surprise repair bills, which is a huge relief for many homeowners.

Performance Guarantees and System Output

Since you're paying for a service—either the equipment or the power it produces—most agreements come with a performance guarantee. Think of it as an insurance policy. The provider promises that the system will generate a certain amount of electricity each year. If it falls short because of an equipment issue or something else on their end, they owe you.

With a PPA, the adjustment is simple: less power generated means a lower bill. For a lease with its fixed monthly payment, the company will usually cut you a check or issue a credit at the end of the year to cover the difference.

Contract Insight: Don't just skim the performance guarantee. Dig into the details. You need to know exactly how they calculate a shortfall and the process for getting reimbursed. This clause is your main protection against paying for a system that isn't pulling its weight.

The Wrinkle: Selling Your Home

Here’s where things can get tricky. What happens if you decide to move? Because you don't own the solar panels, you can’t just roll them into the sale price of your house. The contract has to be dealt with.

You’re usually looking at two main options:

- Transfer the Agreement: The most common route is to have the homebuyer take over the rest of your lease or PPA. This isn't automatic, though. The buyer has to qualify by meeting the solar company's credit standards and officially agree to assume the contract.

- Buy Out the Contract: The other choice is to pay off the remaining balance of the agreement. This can be a hefty sum, but it untangles the property from any solar obligations, making for a cleaner sale.

Be aware that some potential buyers might be hesitant to take on a long-term solar contract. It’s a major consideration that can sometimes complicate the sales process, so it’s something to think about before you sign on the dotted line.

What Happens When the Contract Ends?

Fast forward two decades. The original agreement is up. What's next for the panels on your roof? Your contract will lay out your end-of-term options, and it’s crucial to understand them from day one.

This table breaks down the typical choices you'll have once your solar lease or PPA expires.

| End-of-Term Option | Descripción | Financial Implication | Best For Homeowners Who… |

|---|---|---|---|

| Renew the Agreement | Sign a new lease or PPA, usually for a shorter term like 5-10 years, and often at a better rate. | Keeps your monthly solar payments going but extends your savings without needing to buy anything upfront. | …are satisfied with the service and want to keep saving money on electricity. |

| Purchase the System | Buy the panels and equipment from the provider at their current fair market value. | A one-time payment that gives you full ownership. From that point on, the electricity is truly free. | …want to own the asset and squeeze every last drop of value out of the system. |

| System Removal | The solar company comes and takes the entire system off your roof at no cost to you. | You pay nothing for removal, but you'll go back to paying your utility for 100% of your electricity needs. | …are ready to move on, want to install a newer system, or simply don't need it anymore. |

Each path has its own financial and practical outcomes. Knowing what your choices will be in De 20 a 25 años helps you make a smarter decision today.

Deciding When to Choose a Lease or PPA

Choosing between a solar lease and a Power Purchase Agreement (PPA) isn’t about finding a one-size-fits-all answer. Both get you solar panels with no upfront cost, but they’re built for different financial goals. The real question is: which one fits your life and your home?

Let’s stop talking theory and look at a few real-world situations. This is where you’ll see the differences come to life and can figure out which path makes sense for you.

The Case for a Solar Lease: Predictable Bills for Fixed Incomes

Think about a retired couple living on a fixed income. Their number one priority is budget stability. They need to know exactly what their bills will be every single month, with no surprises. For them, a solar lease is the perfect fit.

A lease comes with a flat, predictable monthly payment, usually somewhere between $100 and $250. That number stays the same whether it’s a cloudy winter or a blazing hot summer. This completely removes the risk of a sky-high electric bill when the AC is running nonstop, offering true peace of mind.

Here’s a quick breakdown:

- Utility Bill Before Solar: Averages $220/month, but often hits $300 in the summer.

- Solar Lease Payment: A fixed $150/month, every month, for the entire 20-year term.

- The Bottom Line: They save an average of $70/month and get total control over their budget. For them, that certainty is worth more than squeezing every last dollar of savings out of the system.

Scenario Insight: A solar lease is almost always the right call for homeowners on a strict budget, retirees, or anyone who simply hates financial surprises. The real value is in the consistency.

When a PPA Shines: The Pay-for-Performance Advantage

Now, let’s picture a young family in a sun-drenched state like Arizona or California. Their main goal is to maximize their savings by capitalizing on all that sunlight. This is where a Power Purchase Agreement (PPA) really shines.

With a PPA, they pay a low, fixed rate per kilowatt-hour (kWh) for the actual energy their panels produce. In a sunny climate, that system will be an energy-generating powerhouse, leading to massive savings compared to the utility’s high rates. Sure, their bills will fluctuate—higher in the summer, lower in the winter—but their total annual savings will almost certainly beat what a lease could offer.

Let’s run the numbers:

- Utility Rate: $0.25/kWh

- PPA Rate: $0.15/kWh

- Summer Production: 1,000 kWh (PPA Bill: $150) vs. Utility Bill ($250) = $100 in savings

- Winter Production: 400 kWh (PPA Bill: $60) vs. Utility Bill ($100) = $40 in savings

Their payments are directly tied to the system’s output. This means they only ever pay for the clean energy they actually get. It’s this direct link between production and cost that makes the PPA model ideal for high-production homes.

The Shading Dilemma: Why a PPA Protects You

Finally, what about a home with some big, beautiful trees that cast shadows on the roof throughout the day? In this case, a fixed-payment lease becomes a financial gamble.

If those panels are shaded for a few hours, energy production drops. But that $150 monthly lease payment? It stays exactly the same. The homeowner ends up paying the full price for an underperforming system.

A PPA acts as a crucial financial safety net here. Since you only pay for the electricity the system actually generates, a dip in production from shading automatically means a lower solar bill. This "pay for what you get" structure ensures you never overpay when your system isn't working at its full potential. For any property with less-than-perfect sun exposure, a PPA is simply the smarter, lower-risk choice.

The Big Picture: Solar Financing is Booming

When you're weighing a solar lease against a Power Purchase Agreement (PPA), you're not just making a personal financial decision—you're stepping into one of the fastest-growing parts of the clean energy world. This isn't some niche market anymore. The growth is real, and it’s driven by some powerful trends that make third-party financing a go-to choice for homeowners.

The main reason? People are tired of unpredictable and rising utility bills. As the cost of grid electricity keeps creeping up, homeowners are actively looking for a way out. Leases and PPAs offer just that: immediate access to clean energy with little to no money down, directly tackling that major headache of high upfront costs.

Why Third-Party Ownership is Skyrocketing

The demand for affordable, accessible solar has made third-party ownership—the model behind both leases and PPAs—incredibly popular. These agreements flip the script on going solar. They completely remove the biggest hurdle for most families: the hefty price tag of buying a system outright. Instead of a purchase, it becomes a simple service, shifting the financial risk and responsibility for performance onto the solar company.

The numbers don't lie. This trend is explosive. The solar lease market is expected to see massive growth in the coming years.

The following chart shows just how significant this expansion is expected to be, with market projections highlighting the increasing adoption of solar leasing services.

As the data shows, the market is projected to grow from an estimated USD 20.91 billion in 2025 to a staggering USD 69.42 billion by 2032. That’s a compound annual growth rate (CAGR) of 18.7%, largely fueled by everyday homeowners. For more details on this trend, you can find a comprehensive analysis in this solar market expansion report from Coherent Market Insights.

The Takeaway: If you're considering a solar lease or PPA, you’re not a guinea pig. You're joining millions of other homeowners who have already gone down this proven path to save money and gain more control over their energy.

What’s Next? Smarter Solar Service Offerings

As the market gets more competitive, the best solar companies aren't just sitting back. They're constantly innovating to pack more value into their lease and PPA contracts. This means the solar lease vs. PPA debate is always evolving, and the new features are a huge win for homeowners.

One of the biggest game-changers is the integration of battery storage. Here’s what top providers are starting to include:

- Bundled Battery Solutions: Many companies now let you add a home battery to your lease or PPA. This is huge—it means you can store the extra solar power your panels generate during the day and use it at night or during an outage.

- Verdadera independencia energética: A solar-plus-storage system gives you real backup power. When the grid fails, your lights and essential appliances stay on.

- Beating Peak Rates: For those in areas with time-of-use utility rates, a battery can be a secret weapon. It can be programmed to power your home during the most expensive peak hours, maximizing your savings.

By rolling these advanced technologies into a single, predictable monthly payment, solar providers are making complete home energy solutions more attainable than ever. This isn't just about panels anymore; it's about building a more resilient and cost-effective energy future, one home at a time.

So, How Do You Choose?

Alright, you’ve seen how solar leases and Power Purchase Agreements (PPAs) stack up. Now it's time to cut through the noise and figure out which one actually makes sense for you, your home, and your wallet. Let's walk through a straightforward, practical process to land on the right decision.

It all boils down to one simple question to start: what's your main financial driver? Your answer will pretty much point you down the right path from the get-go.

First, Nail Down Your Financial Priority

This is the most important piece of the puzzle. Think about how you manage your budget. Do you prefer absolute certainty, knowing exactly what you'll pay every single month? Or are you comfortable with a little fluctuation if it means you're only paying for the power your system actually cranks out?

- If you crave budget stability: Go with a solar lease. You get a fixed monthly payment, period. No surprises, just a predictable bill you can set your watch to.

- If you want performance-based savings: A PPA is your best bet. Your bill will directly track how much electricity the panels generate, which is perfect if you live in a sunny area and want to capitalize on every ray of sunshine.

Just by answering that, you’ve likely eliminated one option and can now dig deeper into the one that fits your style.

Next, Size Up Your Property and Start Shopping

Now, let's look at your house. A solar system is only as good as the roof it's on and the sun it gets. Be realistic about your home's solar-readiness. How old is your roof? Is it in good shape? Crucially, how much direct sunlight do you get, and are there any pesky trees or buildings that might cast a shadow?

Once you have a good sense of your property's potential, it's time to get some real numbers.

Here's a pro tip: Never, ever go with the first quote you get. You need to gather detailed proposals for both a lease and a PPA from at least three different, well-regarded solar companies. It's the only way to know you're not getting taken for a ride.

To make this easier, throw the key details into a simple spreadsheet so you can see everything side-by-side.

| Provider | Contract Type | Monthly Rate/kWh | Annual Escalator | Performance Guarantee | End-of-Term Options |

|---|---|---|---|---|---|

| Company A | Lease | $145 Fixed | 0% | 95% Production | Renew, Purchase, Remove |

| Company B | PPA | $0.16/kWh | 2.5% | 90% Production | Renew, Purchase, Remove |

| Company C | PPA | $0.17/kWh | 1.9% | 92% Production | Renew, Purchase, Remove |

Finally, Read Every Word of the Fine Print

This is the last, and arguably most critical, step. The sales pitch is all about the savings, but the contract is a 20-25 year commitment. You need to comb through it with a fine-tooth comb, paying special attention to these details:

- Escalator Clauses: Does the PPA include an annual rate increase? A seemingly small 1-2% escalator might not sound like much, but it can seriously eat into your savings over two decades.

- Transfer Terms: What happens if you sell your house? You need to know exactly what the process is and if there are any fees involved in transferring the agreement to the new homeowner.

- End-of-Agreement Options: Fast forward 20 years. What are your choices? Make sure the contract clearly spells out the terms for renewing the agreement, buying the system (and at what price?), or having it removed.

By walking through these steps, you take what seems like a complicated choice and turn it into a manageable checklist. This way, you can confidently pick the solar agreement that truly works for you.

Frequently Asked Questions

Even after weighing the pros and cons of solar leases versus PPAs, a few real-world questions usually pop up. Let's tackle some of the most common ones homeowners ask.

What Happens If My Solar Panels Don't Produce Enough Power?

This is a great question and a common worry. Thankfully, both leases and PPAs come with a safety net: a performance guarantee. This is a contractual promise that your system will generate a specific amount of electricity each year.

If your panels fall short because of an equipment problem or anything else that's the provider's fault, you're covered. With a PPA, it's simple—less energy generated automatically means a smaller bill. If you have a lease with a fixed monthly payment, the company will usually cut you a check or issue a credit at the year's end to make up for the value of the lost energy.

Can I Get Out of My Contract Early?

Getting out of a 20- to 25-year solar agreement is possible, but it's not cheap. Most contracts have a buyout clause, letting you purchase the system outright. The cost is usually calculated based on the equipment's fair market value at that time, plus any payments you still owe.

Important Note: Think of early termination as a last-resort option. A buyout can run into thousands of dollars, so be sure you're truly ready for the long-term commitment before you sign.

Who Is Responsible for Damage to the System?

Here’s one of the biggest perks of both leases and PPAs: the solar provider owns the equipment, not you. That means they're on the hook for all the maintenance, repairs, and insurance.

So, if a hailstorm cracks a panel or an inverter gives out, it’s the company’s job to fix or replace it at no cost to you. This completely removes the headache and financial risk of unexpected repair bills, which is a huge relief for many homeowners.

Does a Lease or PPA Increase My Home's Value?

It’s a bit of a mixed bag. Owning your solar panels outright can definitely boost your home's value, but a lease or PPA works differently. Since you don't actually own the system, it's not considered a tangible asset that adds to your property's value.

However, it can make your home more appealing to potential buyers. The promise of lower, stable electricity bills is a strong selling point. The key is ensuring the contract can be transferred to the new owner smoothly and easily.

Ready to explore your solar options with a team you can trust? The experts at Energía radiante can design a solar solution that fits your home and financial goals, ensuring you get the most out of your investment. Get your free solar consultation today.