The biggest difference between a solar lease and a Power Purchase Agreement (PPA) boils down to one simple question: do you want to pay for the equipment or for the power?

With a solar lease, you're essentially renting the equipment for a fixed monthly payment, just like leasing a car. A solar PPA, on the other hand, has you paying a set price per kilowatt-hour (kWh) for the electricity the panels actually generate. Think of it like your normal utility bill, but for clean energy. The right choice really hinges on whether you value predictable monthly costs or prefer a bill that directly mirrors your system’s output.

Choosing Your Solar Financing Path

Going solar is a fantastic move for anyone looking to gain some energy independence and slash their electricity bills. But let's be realistic—the initial investment can be steep. With system costs often landing between $12,000 and $14,000 even after tax credits, buying outright isn't feasible for everyone.

This is where financing options like solar leases and PPAs really shine. They open the door to solar power with little to no money down.

pie

title Solar Financing Options

"Cash Purchase" : 20

"Solar Loan" : 40

"Solar Lease/PPA" : 40

This chart illustrates the common split in financing methods, showing that leasing and PPAs represent a significant portion of how homeowners access solar energy.

In both scenarios, you get the benefits of solar energy without actually owning the panels. The solar company handles the installation, maintenance, and monitoring for the entire contract, which usually runs for De 20 a 25 años. It’s a hands-off approach that removes the headache of repairs and performance checks. Understanding the general benefits of renting vs. owning can provide helpful context here.

The result is a straightforward way to potentially lower your energy costs by 10% to 30%. The trick is figuring out which payment model fits your personal financial style.

Quick Look At Solar Lease vs PPA

Before we get into the nitty-gritty, this table offers a quick snapshot of how these two options stack up. It’s a great way to see the fundamental differences at a glance and get a feel for which path might be a better fit for you.

| Factor | Solar Lease | Solar PPA |

|---|---|---|

| Payment Structure | You pay a flat, fixed monthly fee to rent the solar panels. | You pay a set rate per kilowatt-hour (kWh) for the power produced. |

| Bill Predictability | High: Your payment is the same every month, regardless of output. | Variable: Your bill changes based on how much sun the panels get. |

| Performance Risk | You pay the same fixed amount even if the system underperforms. | You only pay for the energy the system actually generates. |

| Lo mejor para | Homeowners who want a stable, predictable monthly solar bill. | Homeowners who are comfortable with fluctuating bills tied to production. |

This table lays out the core concepts, but the decision ultimately comes down to your comfort level with risk and predictability.

Lo más importante: A solar lease gives you budget certainty with its consistent monthly fee. A PPA connects your payments directly to the system's performance, which means your bill will vary but you never pay for power you don't get.

How a Solar Lease Really Works

If you're looking for budget stability, a solar lease is built for you. It's a lot like leasing a car—you pay a fixed monthly amount to a solar company, and they handle everything else. They install a complete solar panel system on your roof, and you get to use all the power it generates for the life of the contract.

The main draw here is predictability. Your payment stays the same, month after month, for the entire 20 to 25-year term. It doesn't matter if it's a cloudy January or a sun-drenched July; your lease payment is locked in, which makes managing your household expenses incredibly straightforward.

graph TD

subgraph Solar Lease Payment Structure

A[January] --> C{Fixed Monthly Payment};

B[July] --> C;

end

C --> D[Predictable Budget];

Ownership and Maintenance: The Hands-Off Approach

With a solar lease, the solar provider owns the equipment on your roof. This is a key point because it means they're on the hook for all the maintenance and upkeep, not you.

- Zero Maintenance Costs: If a panel goes down or an inverter needs replacing, the company sends a technician out to fix it. You don't pay a dime.

- Control del rendimiento: The provider keeps a close eye on the system's output to make sure it's running efficiently, so you don't have to worry about the technical side of things.

- No Upfront Investment: You get a fully operational solar system without shelling out thousands of dollars to buy it, which is often the biggest barrier for homeowners.

You're essentially getting all the clean energy benefits without any of the headaches of long-term ownership. It's a true set-it-and-forget-it solution.

A solar lease separates energy savings from equipment ownership. You pay for access to the technology, not the technology itself, freeing you from all maintenance and repair obligations.

This model is a huge reason why solar has become so much more accessible. By eliminating the high initial cost, leases have opened the door for more families to go green. On average, a residential solar lease can cut electricity bills by 10-30%. Homeowners get that predictable monthly payment, while the leasing company handles ownership and maintenance for the full 20 to 25-year contract. For a deeper look at the numbers, check out these insights on solar financing.

What Happens When Your Lease Ends?

So, what happens after 20 or 25 years? You’ve got options. Your lease agreement will spell out a few clear paths forward, so you aren't locked into a single outcome.

Typically, your end-of-term choices look like this:

- Renew the Lease: If you've been happy with the setup, you can often extend the contract, sometimes at a newly negotiated, lower rate.

- Have the System Removed: The solar company will come and take the panels off your roof, usually at no extra charge, and get your roof back to how it was.

- Buy the System: You can purchase the panels at their current fair market value. This is a popular choice for people who want to own the asset after enjoying its benefits for two decades.

The best choice really depends on your financial situation and energy needs down the road. The most important thing is to make sure you understand these end-of-lease options before you sign on the dotted line.

Understanding a Solar Power Purchase Agreement

Where a solar lease is all about a fixed monthly payment, a Solar Power Purchase Agreement (PPA) is structured completely differently. With a PPA, you're not renting the equipment; you're agreeing to buy the actual power it generates at a set price per kilowatt-hour (kWh).

This price is almost always locked in at a rate lower than what your local utility company charges—that's the whole point, and it's how you save money. Because of this, the financial setup of a PPA directly ties your monthly solar bill to how well the system performs.

graph TD

subgraph Solar PPA Payment Structure

A[Sunny Month: High Production] --> B(Variable Monthly Payment);

C[Cloudy Month: Low Production] --> B;

end

B --> D[Payment = Production x Rate];

This performance-based model means your bill will go up and down. During those long, bright summer months when the panels are cranking out electricity, your PPA payment will be higher. But in the shorter, cloudier days of winter, your bill will naturally be lower.

Payments Tied to Performance

The biggest draw of a PPA is simple: you never pay for underperformance. If the system stops generating power for any reason, you stop paying. This setup cleverly shifts all the performance risk from your shoulders directly onto the solar provider.

Think about it—the solar company only makes money when your system is working. This gives them a powerful incentive to keep it running at peak efficiency. Just like with a lease, the PPA provider owns the equipment on your roof and takes care of everything.

This typically includes:

- Comprehensive Maintenance: If something breaks, they fix it. All repairs and parts are on their dime, not yours.

- System Monitoring: The provider keeps a close eye on the system’s output to spot and resolve issues right away.

- Performance Guarantees: Many PPA contracts will even guarantee a certain amount of annual production, giving you an extra layer of protection.

This model is a great fit for anyone who wants their solar costs to directly mirror the value they’re getting each month.

A PPA aligns your interests with the solar provider's. You only pay for the energy you get, and they are motivated to maximize the system's output to boost their own revenue.

The Role of the Escalator Clause

A detail you'll often find buried in a PPA contract is the escalator clause. This is a provision that increases your per-kWh rate by a small, fixed percentage each year, usually somewhere between 1% and 3%. The logic is that even with this small annual bump, your solar rate will stay comfortably below the historically rising costs of utility power.

The escalator helps the solar company manage inflation and operational costs over the long 20 to 25-year agreement. But you need to pay close attention to this number. A 2.9% escalator might not sound like much, but over two decades, it really adds up.

Here’s a quick breakdown of how an escalator can change your rate over time:

| Year of Contract | Example Rate (15¢/kWh) | Rate with 2% Escalator |

|---|---|---|

| Year 1 | $0.150 | $0.150 |

| Year 5 | $0.150 | $0.163 |

| Year 10 | $0.150 | $0.179 |

| Year 20 | $0.150 | $0.220 |

As the table shows, understanding the escalator's long-term impact is critical when weighing a PPA against a lease. While your savings might look great in the early years, it’s smart to project how that escalating rate will stack up against your utility's expected price hikes to make sure the PPA stays a good deal for the full term.

A Detailed Comparison of Your Solar Options

Choosing between a solar lease and a Power Purchase Agreement (PPA) really comes down to the fine print. At first glance, they look similar—both get you solar panels with no upfront cost. But how you pay and what you're responsible for are fundamentally different, and those details will shape your experience for the next two decades.

Let's dig into the core mechanics of each agreement. This isn't just a list of features; it's about helping you match the right contract to your own financial style.

Payment Structure: Fixed vs. Variable

The biggest difference between a lease and a PPA is how your monthly bill gets calculated. Think of a solar lease like renting an apartment: you pay a fixed monthly payment for the equipment on your roof. That amount is set in stone in your contract and won't change, no matter how much sun you get.

A Power Purchase Agreement (PPA), on the other hand, works more like a utility bill. You have a variable payment structure where you pay a pre-set price per kilowatt-hour (kWh) for the actual electricity the system generates. Your bill will naturally ebb and flow with the seasons—higher in the long, sunny days of summer and lower in the cloudier winter months.

xychart-beta

title "Solar Lease vs. PPA Monthly Payments (Example)"

x-axis [Jan, Feb, Mar, Apr, May, Jun, Jul, Aug, Sep, Oct, Nov, Dec]

y-axis "Monthly Cost ($)" 0 to 160

line "Lease" [96, 96, 96, 96, 96, 96, 96, 96, 96, 96, 96, 96]

bar "PPA" [41, 62, 98, 125, 148, 155, 160, 145, 120, 85, 55, 40]

This chart shows an example of how monthly payments for the same system might look. The lease payment is a flat line, offering predictability, while the PPA payment fluctuates with seasonal solar production.

Cost Predictability and Budgeting

Your personal preference for budgeting is a huge factor here. The fixed payment of a solar lease offers total predictability. You’ll know exactly what your solar bill will be every single month for the next De 20 a 25 años. It makes managing household expenses incredibly straightforward.

With a PPA, you trade that monthly certainty for the guarantee that you only pay for what you get. While you can generally predict the seasonal ups and downs, the exact amount will vary. This model is a great fit for homeowners who are comfortable with fluctuating payments that directly mirror the system's real-time performance.

With a lease, you're paying for the certainty of a consistent bill. With a PPA, you're paying for the assurance that your costs are tied directly to performance.

Here’s how this plays out in the real world. A typical PPA might have a rate of $0.15 per kWh. In a place where monthly production swings from 273 kWh in winter to over 1,000 kWh in summer, your payments could jump from around $40 to $160. A solar lease for the same system might lock you into a steady $96 a month. The annual cost might end up being almost identical, but the monthly cash flow is a completely different story. You can see more on these financial models in this detailed breakdown of solar leases vs PPAs.

Performance Risk: Who Carries the Weight?

This is a critical point where the two models really diverge. In a PPA, the performance risk is almost entirely on the solar company’s shoulders. Their income is directly tied to the system’s energy production, so they have a powerful incentive to keep the panels clean, functional, and running at peak efficiency. If the system breaks down or underperforms, your bill goes down automatically because you aren't paying for power you didn't receive.

With a solar lease, the homeowner takes on a little more of that risk. You have to keep making that fixed monthly payment even if cloudy weather or a technical glitch causes production to dip. That said, most lease agreements include a performance guarantee, which obligates the company to cut you a check if the system's annual output drops below a promised threshold.

Contract Escalators and Long-Term Costs

It's common to find an annual escalator clause in solar agreements, especially PPAs. This clause nudges your payment rate up by a small, fixed percentage each year—usually between 1% and 3%. The logic is that even with this slight increase, your solar rate will stay comfortably below your utility’s ever-rising prices.

Solar leases can have escalators too, but it’s also common to find flat-rate leases with no increases. Whatever the agreement, you absolutely must run the numbers on the long-term impact of any escalator. A 2% annual bump sounds tiny, but it adds up and can significantly increase your total costs over a 25-year contract.

End of Term Options

So what happens when the 20 or 25-year contract is up? Fortunately, both leases and PPAs give you similar, flexible options for what comes next.

- Renew the Agreement: You can sign on for another term, often at a new, lower rate.

- Purchase the System: You have the option to buy the panels at their current fair market value.

- System Removal: The solar company will come and take the panels off your roof, usually at no cost to you.

The key is to read this part of the contract carefully before you sign. Make sure you understand the buyout process and whether any hidden costs are involved.

Solar Lease vs PPA: A Detailed Side-by-Side Comparison

To really see these differences in action, it helps to put them side-by-side. This table breaks down how a solar lease and a PPA compare across the factors that matter most to homeowners.

| Característica | Solar Lease | Solar Power Purchase Agreement (PPA) |

|---|---|---|

| Payment Model | Fixed monthly payment for renting the equipment. | Pay-per-kWh for the electricity the system produces. |

| Bill Stability | High: Your payment is identical every month. | Variable: Your bill fluctuates based on solar production. |

| Performance Risk | The homeowner pays a fixed fee regardless of output, but is often protected by a performance guarantee. | The solar provider assumes the risk; if the system doesn't produce, you don't pay. |

| Best For Budgeting | Ideal for those who prioritize predictable, consistent monthly bills for easy financial planning. | Suitable for those comfortable with variable payments that align directly with energy generation. |

| Escalator Clause | Less common, but can be included. Many leases offer a flat rate for the full term. | Very common; typically increases the per-kWh rate by 1-3% annually. |

| End of Term | Options include renewal, system purchase at fair market value, or free removal. | Options are the same: renew, purchase, or have the system removed. |

Ultimately, one isn't universally "better" than the other. The right choice depends entirely on your financial comfort zone and whether you value budget predictability over pay-for-performance flexibility.

Making the Right Choice for Your Home

When it comes to solar financing, there's no single "best" answer. The debate between a solar lease and a PPA really comes down to what works for you and your financial comfort zone. Are you someone who prefers predictable, steady bills, or are you more comfortable with a payment that reflects your system's actual performance?

How you answer that question will shape your energy savings and budget for years to come. To figure it out, it helps to know what kind of solar homeowner you are.

Are You a Budget Planner or a Performance Maximizer?

Think about how you handle your monthly household finances. This simple self-assessment can point you in the right direction almost immediately.

-

The Budget Planner: If you run a tight ship and want to know exactly what your solar bill will be every single month, a solar lease is probably your best bet. The fixed monthly payment removes all guesswork, making your financial planning clean and simple.

-

The Performance Maximizer: If you’re the type who likes to see costs tied directly to value, a solar PPA is a natural fit. You only pay for the kilowatt-hours the system actually generates, so your bill will fluctuate with the seasons, but your investment is always linked to performance.

That idea of a fluctuating bill gives some people pause. But if you live in a place with consistent, year-round sun, the ups and downs of a PPA might be so small you barely notice them. On the other hand, if you're in a region with long, cloudy winters, the stability of a lease can offer some welcome peace of mind.

Your tolerance for fluctuating bills is the key differentiator. A lease insulates you from seasonal production dips with a flat fee, while a PPA embraces them by adjusting your bill accordingly.

Navigating Your Decision with a Clear Framework

Choosing between a lease and a PPA is a common crossroads for homeowners today. The global solar lease service market is exploding, projected to grow from USD 20.91 billion in 2025 to a massive USD 69.42 billion by 2032. This trend is driven by rising electricity costs and a growing desire for clean energy without the upfront investment. While commercial projects often drive PPA growth, residential leases are catching on fast—one report estimated that over 23% of U.S. solar customers would choose a lease by 2023.

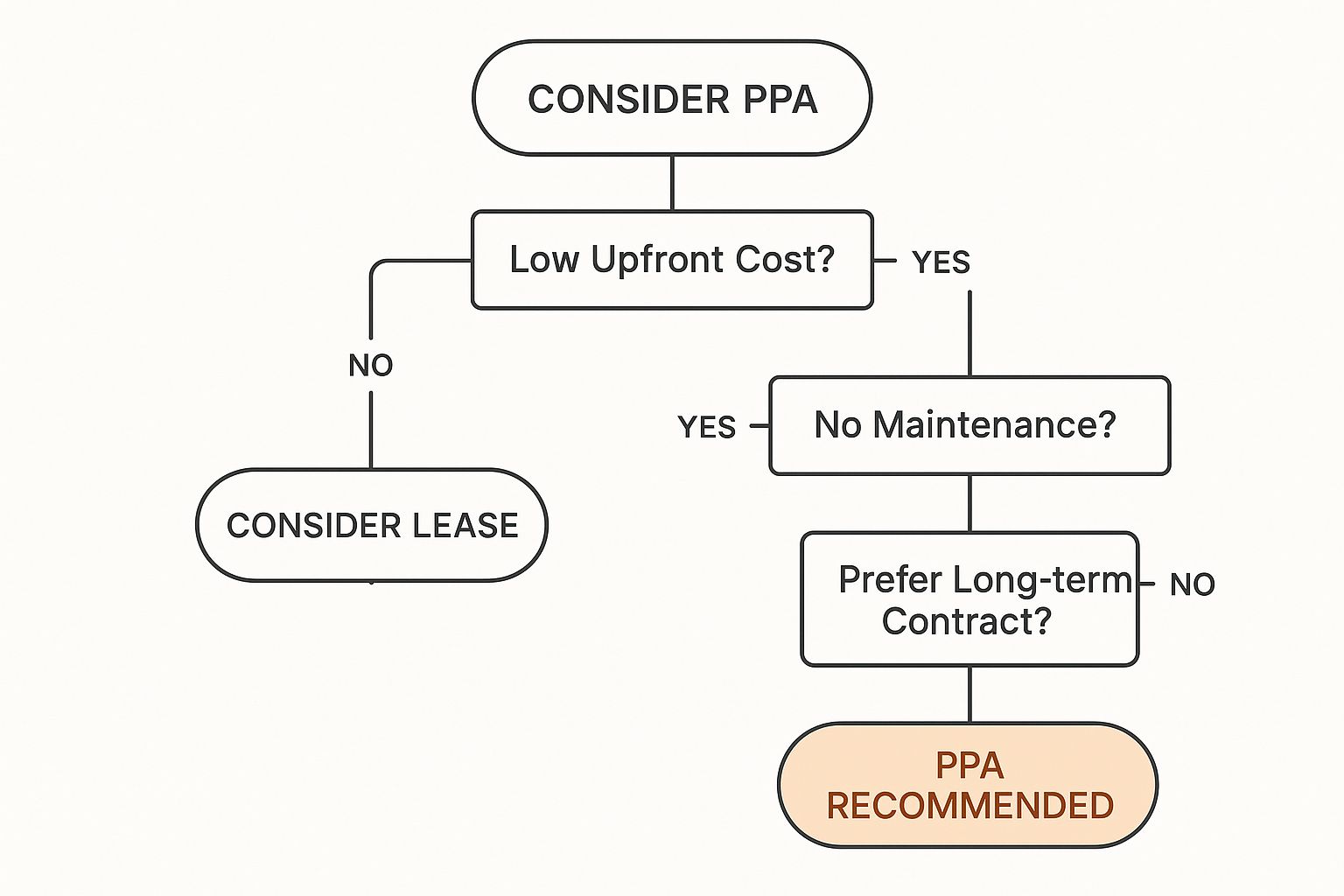

This decision tree can help you visualize the choice by walking you through the most important factors.

As the chart makes clear, if your top priorities are avoiding upfront costs and maintenance headaches while locking in a long-term, hands-off agreement, then a PPA is a highly recommended path.

Key Questions to Guide Your Choice

To really personalize this decision, take a moment to ask yourself these direct questions. Your answers will build a profile that points you toward the right financing model for your home.

- How important is a predictable monthly bill to me? If your answer is "very," then a solar lease is the clear frontrunner. If you’re okay with some flexibility, a PPA is still a great option.

- Does my local climate have big seasonal swings in sunshine? For areas with dramatic seasonal changes, a lease offers payment stability through those cloudy months. In consistently sunny climates, a PPA's pay-as-you-go rate can feel more transparent and fair.

- Am I more focused on cost certainty or paying for actual output? This gets to the heart of it. A lease gives you guaranteed costs, while a PPA ties your payments directly to performance.

- Have I considered the total long-term cost? The monthly payment is just one piece of the puzzle. It’s worth digging into the full financial picture, and you can learn more about what goes into the total https://radiantenergysolar.com/your-guide-to-solar-panel-system-installation-cost/ en nuestra guía detallada.

One final thought before you decide: take a look at your home's foundation—specifically, your roof. It’s crucial to make sure it's in top condition before installing panels. If you're in Massachusetts, for example, it might be a good idea to consult with local roofing contractors. A solid roof ensures your solar investment is secure for the entire life of the agreement. By weighing these personal, environmental, and structural factors, you can confidently choose the solar financing option that truly fits your home and your goals.

Answering Your Top Solar Financing Questions

When you're looking at a solar agreement, you're not just picking a payment plan—you're getting into a partnership that could last two decades. It's only natural that some practical, long-term questions come up. Let's walk through the most common things homeowners ask when comparing a solar lease and a PPA.

What Happens If I Sell My House With a Solar Lease or PPA?

This is easily one of the biggest questions people have, and for good reason. The good news is that solar companies have this process down to a science.

When you decide to sell, the solar agreement is designed to transfer to the new owner. Your solar provider will have a dedicated team to help you, your agent, and the buyer handle the paperwork. The only real requirement is that the new homeowner has to meet the company's credit standards to take over the agreement.

Of course, you might have another option. Many contracts allow you to buy out the rest of the agreement. You can then sell the solar system as a fully owned asset, which can often boost your home's value. When you're in this situation, understanding assignment in contracts is incredibly helpful.

Do I Qualify for Tax Credits With a Lease or PPA?

The short answer is no. With both a solar lease and a PPA, you personally don't get to claim the federal solar tax credit or any local incentives.

Because the solar company technically owns the equipment on your roof, they are the ones who claim those financial perks. This is the fundamental trade-off. In exchange for giving up the tax credits, you get to put a solar system on your roof for $0 upfront cost. The provider basically uses the value of those incentives to bring down the monthly lease payment or the per-kWh PPA rate they offer you.

Información clave: The solar company leverages tax credits to make the lease or PPA affordable for you. You trade direct incentives for the convenience and accessibility of a no-cost installation.

This is what makes going solar possible for so many homeowners who don't have the cash on hand for a full purchase. To get a better feel for the numbers involved in a purchase, check out our guide on how much solar panels cost.

Who Is Responsible for System Repairs and Maintenance?

Your solar provider is 100% responsible. They handle all maintenance, monitoring, and repairs for the entire life of the contract, which is usually De 20 a 25 años.

Honestly, this is one of the biggest draws of a lease or PPA. You get a completely worry-free, hands-off experience.

- Repairs at No Cost: If an inverter goes down or a panel gets damaged, the company fixes or replaces it on their dime, not yours.

- Control del rendimiento: They are constantly monitoring the system’s energy output from their end. They often know something’s wrong before you do.

- Production Guarantees: Most agreements come with a guarantee. If your system doesn't produce the amount of power they promised in a given year, they'll usually cut you a check for the difference.

This all-inclusive coverage means you never have to stress about surprise repair bills or figuring out the technical side of things. It’s the definition of a "set-it-and-forget-it" solar solution.

Can I Buy the System When the Contract Ends?

Yes, absolutely. Just about every solar lease and PPA contract gives you a few different paths to choose from once the initial term is up.

After the 20 or 25-year agreement ends, you typically have these choices:

- Purchase the System: You can buy the panels and equipment at their current fair market value. Since the system is older, the price will be much lower than buying new.

- Renew the Agreement: Happy with the setup? You can often sign on for another term, sometimes even at a reduced monthly rate.

- Remove the System: If you're done with solar, the company will send a crew to uninstall the panels and return your roof to how it was, at no cost to you.

The nitty-gritty details, like how they calculate "fair market value," will all be spelled out in your contract. It's always a good idea to read that section carefully before you sign.

Ready to explore a solar solution that fits your home and budget perfectly? The experts at Energía radiante can design a high-quality solar energy system, handle the installation, and provide ongoing support to help you achieve energy independence. Find out how we can help you start your solar journey today!