So, you're wondering about the real cost of going solar. It's the first question on everyone's mind, and the answer isn't a simple one-size-fits-all number. Generally speaking, a typical residential solar panel installation will run you somewhere between $25,000 and $50,000 before any tax credits or rebates kick in.

That big range breaks down to a more manageable metric: about $2 to $3 per watt. Where you land in that range depends on a handful of key factors, like where you live, the size of your system, and the specific equipment you choose.

Understanding the True Cost of Solar Energy

Before we get bogged down in the numbers, it's worth remembering that this is more than just a home improvement project. It's about tapping into a clean power source that's sitting right on your roof, which ties into the broader vision of harnessing solar energy for a cleaner planet.

Now, back to the money. The upfront cost can feel like a big hurdle, but it's just one part of the financial equation. Solar panel installation costs have been on a bit of a rollercoaster lately, influenced by everything from global equipment prices to local labor and permitting headaches.

But even with those upfront costs, solar continues to be a fantastic investment for most homeowners. The proof? On average, U.S. households with solar save around $1,500 every single year on their electricity bills. That adds up fast.

Estimated Solar System Costs by Size

To put some real numbers to this, let's look at what you might expect to pay for different system sizes. The chart below gives you a ballpark idea of the initial investment before you factor in any juicy tax credits or local incentives, which can seriously slash the final price tag.

graph TD

A[5 kW System<br>$14,500] --> B[8 kW System<br>$22,400];

B --> C[10 kW System<br>$27,500];

C --> D[12 kW System<br>$32,400];

style A fill:#f9f,stroke:#333,stroke-width:2px

style B fill:#f9f,stroke:#333,stroke-width:2px

style C fill:#f9f,stroke:#333,stroke-width:2px

style D fill:#f9f,stroke:#333,stroke-width:2px

Notice the trend? As the system gets bigger, the cost per watt actually goes down. It's a classic case of economy of scale. This is why a slightly larger system can sometimes offer a much better long-term return, especially if your family uses a lot of electricity.

Of course, these are just averages. For a deeper dive into whether the numbers make sense for your specific home and budget, you'll want to check out our complete guide on if solar energy is worth it.

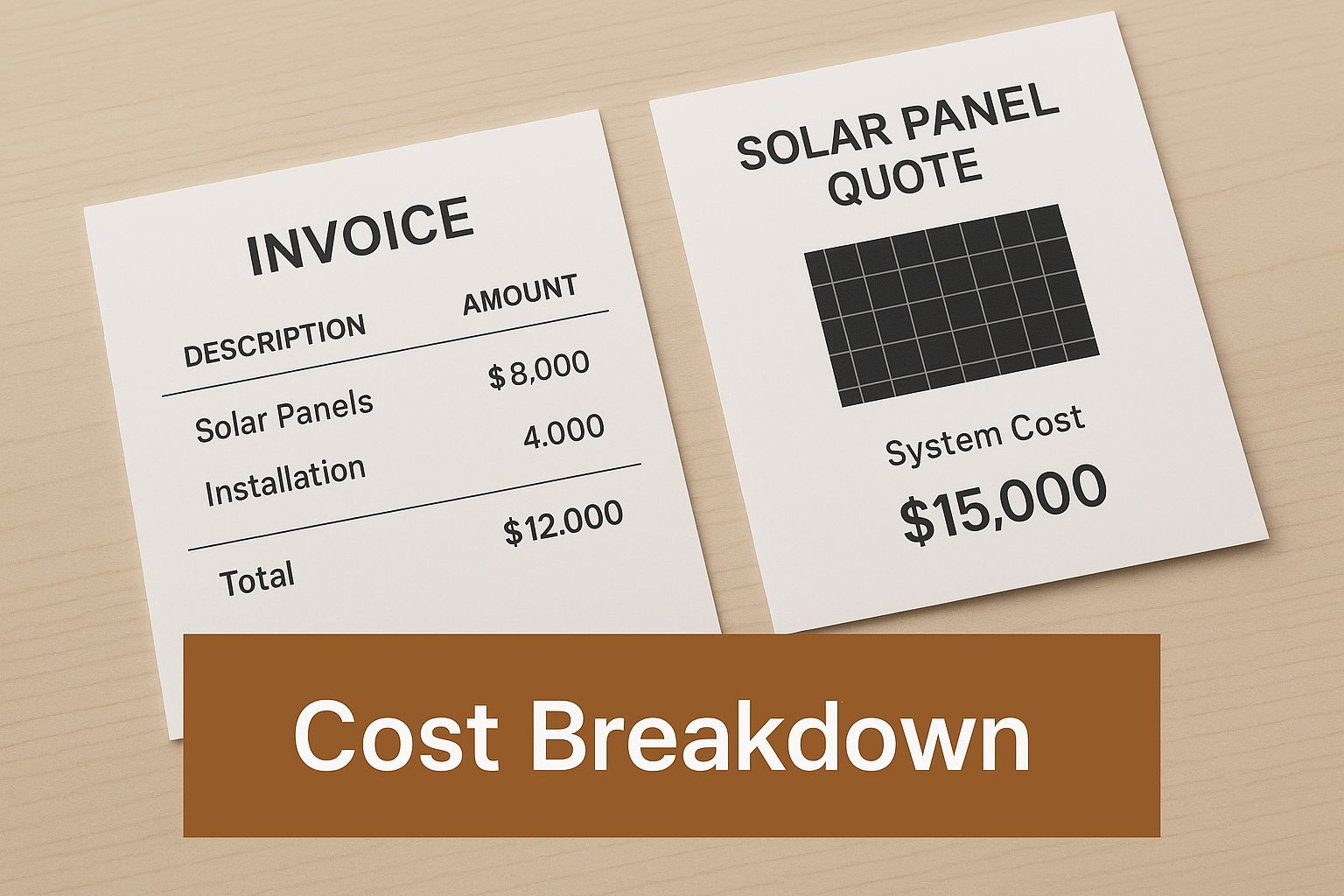

Deconstructing the Price Tag of a Solar System

So, you're looking at going solar and wondering where all the money actually goes. It’s easy to see the total cost and feel a bit of sticker shock, but that big number is really a sum of many smaller parts. It helps to think of it like building a custom home—the final price isn’t just the lumber and nails; it's the architect's plans, the city permits, and the skilled crew that puts it all together.

In the world of solar, the price breaks down into two main buckets: hard costs y soft costs. Getting a handle on this split is the first step to truly understanding your investment.

Hard Costs: The Physical Equipment

Hard costs are exactly what they sound like—the tangible, physical hardware you can see and touch. This is all the gear that gets installed on your roof and wired into your home. This equipment typically makes up about 35-45% of the total project price.

Here's what you're buying:

- Solar Panels: This is the most obvious part. The price tag here depends on the brand, how efficient they are, and the power output (wattage) of the panels you select.

- Inverter: Think of this as the brains of the whole operation. It takes the direct current (DC) electricity your panels generate and converts it into the alternating current (AC) that your coffee maker and TV can actually use.

- Racking and Mounting: This is the sturdy framework that safely secures the panels to your roof. The cost can shift based on your roof’s material and slope, as some surfaces need more specialized hardware. In fact, any reputable installer will first make sure your home meets all the necessary solar panel roof requirements before finalizing this part of the job.

- Wiring and Electrical Components: This covers all the wires, conduits, and safety disconnects needed to tie everything together safely and bring it up to code.

This infographic does a great job of showing where each dollar goes in a typical solar project.

As you can see, the "soft costs" often take up the biggest slice of the pie, which comes as a surprise to a lot of homeowners.

Soft Costs: The Invisible Price Drivers

While the hardware is pretty straightforward, the soft costs are where the numbers can really start to differ from one project to the next. These are all the non-equipment expenses that are absolutely essential for a legal, safe, and successful installation. It's wild, but soft costs can easily account for 55-65% or even more of the total project cost.

pie

title Solar Project Cost Breakdown

"Hard Costs (Equipment)" : 40

"Soft Costs (Labor, Permits, etc.)" : 60

These expenses are less visible, but they are every bit as important.

Lo más importante: The majority of what you pay for a solar system covers the expertise, labor, and administrative hoops needed to get it running—not just the panels themselves.

Let’s pull back the curtain on what's included in this big category.

1. Labor and Installation

This is the single biggest soft cost, period. You're paying for a certified team of electricians and installers to spend time on your roof, mounting the panels, running conduit, and connecting everything to the grid. A top-notch installation is what guarantees your system performs at its peak and stays safe for decades to come.

2. Permitting and Inspection Fees

Before a single panel goes up, your installer has to submit detailed plans to your local city or county for approval. This involves creating engineering diagrams and proving the project meets all local building and electrical codes. Then, after the work is done, a final inspection is required before you can flip the switch. These fees can vary dramatically from one town to the next.

3. System Design and Engineering

Every solar system should be a custom job. Engineers look at your roof’s angle, your past energy bills, and local weather data to design a system that will squeeze every last drop of energy out of the sun and give you the best financial return.

4. Interconnection Fees

Your local utility company has to give the green light before your system can be connected to their grid. This process, known as interconnection, usually involves an application and a fee. It’s all about making sure your system can safely send any extra power you generate back to them.

5. Overhead and Operational Costs

Finally, a piece of the price covers the solar company's cost of doing business. This includes things like insurance, customer support, marketing, and project management—all the behind-the-scenes work that makes sure your project goes off without a hitch.

How Your Location Shapes Solar Installation Costs

When you're figuring out the cost of solar panels, your zip code is just as important as the size of the system. Seriously. An identical 8kW system on a roof in Phoenix could easily cost thousands less than the same setup in Boston. It's not a small discrepancy—geography is one of the biggest drivers of the final price you'll pay.

Think about it like the housing market. A three-bedroom house in Omaha is going to have a very different price tag than the exact same house in San Francisco. The same dynamic is at play with solar, driven by local labor rates, the hassle of permitting, and even how much sunshine you get.

This is exactly why getting local quotes is non-negotiable. A national average is a decent starting point, but it's the on-the-ground reality in your town that dictates your actual budget.

Why Prices Vary So Much State By State

So, what’s really behind these wild price swings from one state to the next? It all comes down to a handful of local economic and regulatory factors that can either help or hurt your bottom line.

These elements combine to create a totally unique financial picture for solar in every state.

-

Labor Rates and Competition: In states with a booming solar industry, you’ll find tons of installers competing for your business, which naturally helps keep prices in check. On the flip side, if you're in an area with just a few certified installers or where wages are high, those labor costs will show up on your quote.

-

Local Permitting and Inspection Rules: This is a huge one. Some cities have their act together with simple, fast online permitting. Others are a bureaucratic nightmare of paperwork and multiple inspections, piling on "soft costs" and frustrating delays that installers have to bake into their price.

-

Sunlight Availability (Insolation): It's just common sense—states in the Sun Belt like Arizona and Texas get way more sun than the Northeast. That means a smaller, more affordable system in a sunny state can crank out the same power as a larger, pricier one in a cloudier region.

A Look at Regional Solar Costs

To put some real numbers to this, let's look at the average cost per watt across the country. It’s the industry-standard metric for comparing prices, and it shows just how much your location moves the needle.

Of course, the price you see is also shaped by local incentives and the specific equipment you choose. For instance, residential systems typically run from $10,290 to $20,580, but local and state rebates can knock off up to $5,000 después de you’ve claimed the federal tax credit. This is why it pays to understand how local markets influence solar pricing.

This chart visualizes the typical cost per watt, giving you a ballpark for your part of the country.

gantt

title Average Solar Cost Per Watt by U.S. Region

dateFormat x

axisFormat $%S.x

section Southwest

Arizona, TX, NV : 2.50, 0.35

section Southeast

Florida, Georgia : 2.60, 0.35

section Midwest

Ohio, IL, MI : 2.80, 0.40

section West

California, OR : 2.85, 0.45

section Northeast

New York, MA : 2.95, 0.55

Note: These are average figures and can vary based on the specific installer and equipment.

Información clave: Don't let the higher sticker price in the Northeast scare you off. While the upfront cost is often greater, these states frequently have some of the best incentives and SREC markets in the country, which can drastically improve your long-term return.

At the end of the day, knowing about these regional quirks helps you set realistic expectations. It arms you with the right questions to ask when you get quotes, making sure you’re getting a fair shake for your area.

Unlocking Savings with Tax Credits and Rebates

The sticker price you see on a solar quote is almost never what you actually end up paying. Think of that initial number as the starting point, not the finish line. A powerful combination of federal, state, and even local incentives can dramatically reduce your final solar panel installation costs, turning what looks like a major expense into a much more manageable investment.

Getting a handle on these programs is the key to unlocking the true financial power of going solar. They were created to make clean energy more accessible, and taking full advantage of them is a critical first step. Let's start with the biggest one available to nearly every qualifying U.S. homeowner.

Explicación del crédito fiscal federal para la energía solar

The most significant financial boost comes from the Residential Clean Energy Credit. This isn’t just a simple deduction from your income; it's a powerful, dollar-for-dollar credit that directly cuts down the federal income tax you owe. For any system installed between 2022 and 2032, this credit is worth a massive 30% of the total project cost.

So, how does this actually work for you?

- Eligibility: To qualify, you have to own your home (renters aren't eligible) and owe federal income tax for the year. The system itself must also be new, not secondhand.

- Covered Costs: En 30% applies to the whole shebang—the panels, inverter, mounting hardware, all the labor for prep and installation, and even battery storage systems.

- Claiming the Credit: You’ll claim the credit when you file your annual federal taxes using IRS Form 5695. If the credit you earned is more than what you owe in taxes that year, no problem. You can simply roll the remaining amount over to the next year.

This federal incentive alone can slash thousands of dollars off your final bill. On a $30,000 system, a 30% credit means you'd get $9,000 back, effectively lowering your net cost to just $21,000.

Stacking State and Local Incentives for Maximum Savings

While the federal tax credit is a huge help, the savings don't stop there. Many states, counties, and local utility companies offer their own programs that you can "stack" right on top of the federal credit. This is where your final solar panel installation costs can really start to plummet.

These programs change a lot depending on where you live, so a little local research is essential.

Common Types of Local Incentives:

- Créditos fiscales estatales: Some states offer their own tax credits, giving you a second layer of savings that reduces your state income tax bill.

- Reembolsos en efectivo: Many utilities or state energy offices offer straightforward cash rebates. This is often a set amount per watt of solar you install, putting cash back in your pocket soon after the system is up and running.

- Solar Renewable Energy Credits (SRECs): In certain states, your system earns credits (SRECs) for the clean energy it generates. You can then sell these credits on a market to utilities, which creates a nice, ongoing source of income.

- Property Tax Exemptions: Adding solar panels almost always increases your home's value. To encourage this, many states have laws that exempt this added value from your property tax assessment. You get the higher home value without the higher tax bill.

To get a clearer picture of your options, it's a great idea to explore a detailed breakdown of how much solar panels cost with incentives factored in.

A Practical Example of Stacking Incentives

Let's walk through how this all comes together. Imagine a homeowner in New Jersey gets a quote for $35,000 for a new solar panel system.

flowchart TD

A[Start: Gross Cost<br>$35,000] --> B{Apply 30% Federal<br>Tax Credit};

B --> C[Savings: $10,500];

C --> D[New Cost: $24,500];

D --> E{Factor in Utility<br>Rebate};

E --> F[Savings: $500];

F --> G[Final Net Cost<br>$24,000];

style G fill:#9f9,stroke:#333,stroke-width:2px

- Start with the Gross Cost: The initial price tag is $35,000.

- Apply the Federal Tax Credit: They can immediately claim 30% of that cost on their federal taxes. That's a $10,500 credit, which brings their cost down to $24,500.

- Factor in State Incentives: In New Jersey, homeowners can earn SRECs for the power their system generates. This could translate into an ongoing income of several hundred dollars per year.

- Check for Utility Rebates: Let's say their local utility offers a one-time rebate of $500. Now their net cost is down to $24,000.

Just by strategically layering these programs, the homeowner cut their net investment from $35,000 down to $24,000—and that’s before counting any future income from SRECs or the money saved on their monthly electricity bills. This shows just how important it is to look beyond the initial quote and understand the full financial picture.

Understanding which incentives you qualify for is the first step toward making your solar project as affordable as possible. This checklist breaks down the most common types.

Maximizing Your Solar Savings: A Checklist

| Tipo de incentivo | What It Is | Typical Value | How to Qualify |

|---|---|---|---|

| Federal Tax Credit | A dollar-for-dollar credit against your federal income tax liability. | 30% of total system cost. | Own your home, owe federal taxes, and install a new system. |

| State Tax Credits | Similar to the federal credit, but applies to your state income tax. | Varies by state, often 10-25% or a fixed amount. | Reside in a state with a program and meet its specific requirements. |

| Cash Rebates | A direct payment from a utility or state agency after installation. | Usually calculated per watt (e.g., $0.20/watt) or as a flat fee. | Be a customer of a participating utility or live in a specific area. |

| SRECs | Tradable credits earned by producing solar energy, sold for income. | Market-based; can be hundreds to thousands of dollars annually. | Live in a state with an active SREC market (mostly Northeastern states). |

| Property Tax Exemption | Prevents your property taxes from increasing due to the value added by solar. | Varies based on your local property tax rate. | Automatically applied in many states that have this exemption law. |

Taking the time to research and apply for every available program is well worth the effort. It’s the surest way to significantly lower your upfront investment and speed up your return on that investment.

Calculating Your Solar Return on Investment

It’s easy to get hung up on the upfront cost of a solar panel system. But to really understand the value, you have to shift your thinking from a simple purchase to a long-term investment in your home. The sticker price is just the starting point; the real story unfolds over years of shrinking energy bills and a rising property value.

The best way to measure this is by figuring out your solar payback period. Think of it as your break-even point—the exact moment your system's savings have officially paid off your initial investment. After that, every bit of energy your panels generate is pure profit, giving you free electricity for the rest of their lifespan.

The Solar Payback Period Formula

Calculating this isn't nearly as intimidating as it sounds. At its heart, it's a simple formula that pits what you paid against what you save each year. This gives you a clear timeline for when your solar panels start paying you back.

Here’s the basic equation:

Solar Payback Period (in years) = Net System Cost / Annual Financial Benefits

Let's quickly unpack what each of those terms really means so you can pencil out your own numbers.

-

Coste neto del sistema: This isn't the number on the initial quote. It’s what you actually pay out-of-pocket after all the discounts are factored in. Take the gross installation price, then subtract the federal tax credit, any state or local credits, and cash rebates you might get from your utility company.

-

Annual Financial Benefits: This is the total value your system kicks back to you every year. It’s a mix of what you save on electricity (the money you're no sending to the power company anymore) plus any extra income you might earn from programs like SRECs.

Putting It All Together: A Real-World Scenario

Let's walk through an example. Say a homeowner gets a quote for a $30,000 system.

First, they apply the 30% federal tax credit, which instantly knocks $9,000 off the price. Their net cost is now down to $21,000.

Next, we look at their annual benefits. Their power bills drop by an average of $150 a month, which adds up to $1,800 in savings for the year. They also live in a state where they can sell SRECs, earning them another $300 annually.

- Total Annual Benefit: $1,800 (savings) + $300 (SRECs) = $2,100

- Payback Period Calculation: $21,000 / $2,100 = 10 años

In this case, the system pays for itself in a decade. With most modern panels warrantied for 25 años or more, that homeowner is looking at a solid Más de 15 años of free electricity.

The Long-Term Financial Outlook

The financial case for solar is stronger than ever. The cost of solar panels plummeted by more than 60% between 2010 and 2020, and solar battery prices have dropped an incredible 72% since 2015. Thanks to these falling costs, a typical payback period now often lands in the 6 to 8-year range, making it one of the smartest long-term investments you can make for your home. You can dig into more of these numbers by checking out these comprehensive solar energy statistics.

Of course, to get the best possible return, you need to keep your system running at its peak. This means factoring in minor ongoing expenses, and a big part of that is understanding the full costs and benefits of solar panel cleaning services to ensure you’re maximizing your energy production year after year.

Finally, don't forget about the immediate boost to your property value. Study after study confirms that homes with solar panels sell for a premium. Even better, many states offer property tax exemptions for solar installations. This means you get all the upside of a more valuable home without the sting of a higher tax bill—a win-win for your monthly budget and your overall net worth.

A Few More Questions About Solar Panel Costs

Even with a detailed breakdown, a few questions always seem to come up as homeowners start to think seriously about their budget. Let’s tackle some of the most common ones I hear from folks trying to get the complete financial picture for their solar panel installation costs. Getting these sorted out now means no surprises later on.

We'll run through four of the most frequent questions to give you the straightforward answers you need to feel confident about your decision.

What Are the Long-Term Maintenance Costs?

This is probably the number one question I get, and the answer is one of the best parts about solar: next to nothing. Solar panels are built like tanks, designed to handle decades of sun, rain, and snow with very little fuss. They don’t have any moving parts, so the risk of a mechanical breakdown is incredibly low.

For most people, the only "maintenance" you'll ever do is:

- An Annual Cleaning: A quick spray with a hose once a year is usually all it takes to wash off any dust or pollen that might be blocking a tiny bit of sunlight. If you live in a particularly dusty spot, you might do it a couple of times a year.

- Occasional Professional Check-ups: It's smart to have an installer swing by every few years just to make sure all the connections are tight and everything is performing as it should. This isn't a major expense by any means.

All in all, you can pencil in about 1% of your system's total cost per year for potential upkeep, but honestly, most people spend much, much less.

Can I Save Money with a DIY Installation?

I get it. For the handy homeowner, the thought of a DIY solar project is pretty appealing. And yes, you can technically save on labor costs by doing it yourself. But—and this is a big but—it comes with some serious risks that can easily wipe out any savings.

We’re talking about high-voltage electrical work and physically mounting heavy equipment to your roof. One wrong move could lead to a dangerous situation, a fried warranty, or a system that just doesn't produce what it should.

On top of that, professional installers handle all the tricky permitting and paperwork needed to connect to the grid. Trying to navigate that bureaucratic maze on your own can be a massive headache. For almost everyone, the safety, guaranteed performance, and peace of mind you get from a pro is worth every penny.

How Does Adding a Solar Battery Affect the Price?

Adding a battery is a game-changer for energy independence, especially if you want to keep the lights on during a blackout. It does, however, add a noticeable chunk to the initial solar panel installation costs. A solid home battery system will typically add $8,000 to $15,000, sometimes more, to your project.

While that's a bigger number upfront, remember that the federal tax credit applies to the battery as well, which definitely helps. A battery doesn't just provide backup power; it can also help you sidestep those expensive peak electricity rates from the utility company, giving it a long-term value that goes beyond just saving on your bill.

What Financing Options Are Available?

You don't need to have a mountain of cash sitting around to make the switch to solar. There are a few great financing paths that make it work for just about any budget:

- Solar Loans: This is the most popular choice. You finance the system just like you would a car, make regular monthly payments, and you own it from day one. This means all the tax credits and incentives are yours to claim.

- Solar Leases: With a lease, you pay a fixed monthly amount to a solar company to use the system they install on your roof. There's usually zero upfront cost, but you don't own the equipment and can't claim the financial perks.

- Power Purchase Agreements (PPAs): A PPA is a lot like a lease. A company installs and owns the panels on your house, and you simply agree to buy the electricity it generates at a predetermined rate, which is almost always cheaper than what the utility charges.

Ready to see how these numbers apply to your home? The experts at Energía radiante can provide a customized quote that breaks down all costs and potential savings. Get your free solar assessment today!